Thomas Real Estate Company (organized as a corporation on April 1, 2003) has completed the ac- L03

Question:

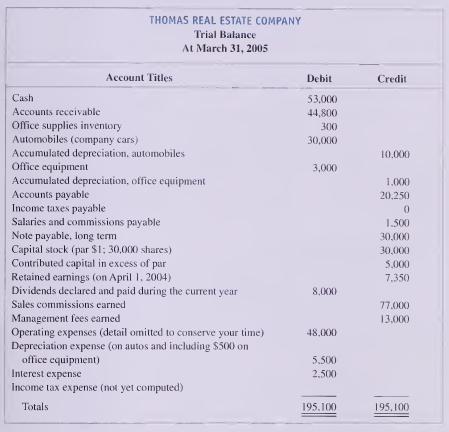

Thomas Real Estate Company (organized as a corporation on April 1, 2003) has completed the ac-

L03 counting cycle for the second year, ended March 3 1 , 2005. Thomas also has completed a correct trial balance as follows:

Required: 1. Complete the financial statements, as follows:

a. Income statement for the reporting year ended March 31, 2005. Include income tax expense, assuming a 30 percent tax rate. Use the following major captions: Revenues. Expenses, Pretax Income, Income Tax, Net Income, and EPS (list each item under these captions).

b. Balance sheet at the end of the reporting year, March 31, 2005. Include (1) income taxes for the current year in Income Taxes Payable and (2) dividends in Retained Earnings. Use the following captions (list each item under these captions). 2. Give the journal entry to record income taxes for the year (not yet paid).

2. Give the journal entry to record income taxes for the year (not yet paid).

Step by Step Answer: