(Timeline; payback; NPV) Dudleys Delivery Service is considering the purchase of a new van to replace an...

Question:

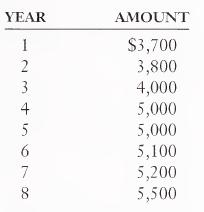

(Timeline; payback; NPV) Dudley’s Delivery Service is considering the purchase of a new van to replace an existing truck. The van would cost $25,000 and would have a life of 8 years with no salvage value at that time. The truck could be sold currently for $3,000; alternatively, if it is kept, it will have a remaining life of 8 years with no salvage value. By purchasing the van, Dudley’s would anticipate operating cost savings as follows.

Dudley’s cost of capital and capital project evaluation rate is 11 percent.

a. Construct a timeline for the purchase of the van.

b. Determine the payback period (ignore tax).

c. Calculate the net present value of the van (ignore tax).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: