(Timeline; payback; NPV) Lola of Lolas General Store is considering leasing an adjoining building to stock additional...

Question:

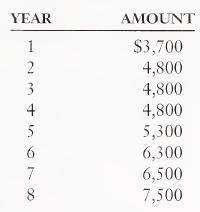

(Timeline; payback; NPV) Lola of Lola’s General Store is considering leasing an adjoining building to stock additional merchandise for travelers and tourists. The owner of the building has offered Lola an 8-year lease. Lola anticipates that upfront repairs and improvements costing $60,000 would be necessary to make the building suitable for her purposes. Although Lola would need to invest in CHAPTER 18 Capital Budgeting 859 additional inventory, her suppliers are willing to provide inventory on a con¬ signment basis. Annual incremental fixed cash costs (including the cost of the lease) of the facility are expected to be as follows:

Lola estimates that annual cash inflows could be increased by $80,000 from the additional merchandise sales. The firm’s contribution margin is typically 20 percent of sales. At the end of the lease, Lola would not be entitled to any payment for improvements she makes to the building. The firm uses a 9 percent discount rate.

a. Construct a timeline for the building lease.

b. Determine the payback period (ignore tax).

c. Calculate the net present value of the project (ignore tax).

Step by Step Answer: