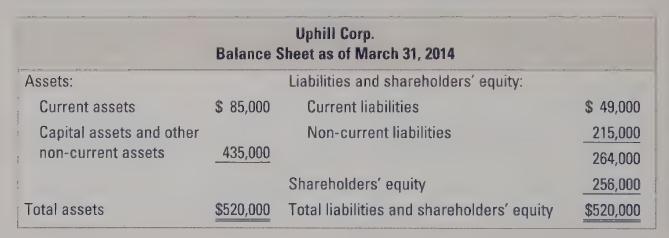

Uphill Corp. (Uphill) operates amusement arcades throughout Atlantic Canada. Uphills summarized balance sheet on March 31, 2014

Question:

Uphill Corp. (Uphill) operates amusement arcades throughout Atlantic Canada. Uphill’s summarized balance sheet on March 31, 2014 is shown below.

The non-current liabilities of \($215,000\) include a \($120,000\) term note that matures in 2020. The terms of the note stipulate that Uphill must maintain a current ratio greater than 1.4 and a debt-to-equity ratio of less than 1.5. If either of these covenants is violated, the term note becomes payable immediately.

In January 2014, management decided, in response to declining revenues, to upgrade the quality of the games in the arcades, many of which were no longer popular with the young people who are Uphill’s primary customers. Uphill arranged a 10-year lease for new games from an equipment manufacturer. The terms of the lease require annual payments of \($35,000\). A key condition of the lease is that it allows Uphill to replace up to 25 percent of the leased arcade games each year with newer games carried by the lessor. The lease goes into effect on April 1, 2014.

Required:

a. Calculate the current ratio and debt-to-equity ratio on March 31, 2014.

b. Calculate the current ratio and debt-to-equity ratio on April 1, 2014, if the new lease is accounted for as an operating lease.

c. Calculate the current ratio and debt-to-equity ratio on April 1, 2014, if the new lease is accounted for as a capital lease. Assume that the appropriate interest rate that should be applied to the lease is 9 percent. Assume the first payment is due on April 1, 2014.

d. You are Uphill’s controller. The president of the company has just informed you of his plan to lease the new arcade equipment. Write a memo to the president raising any concerns you have with the plan and providing advice and recommendations on how he should proceed.

Step by Step Answer: