West Coast Recycling Ltd. (WRCL) is a Nanaimo, British Columbia-based company specializing in the collection and reprocessing

Question:

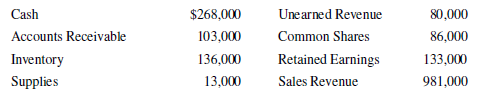

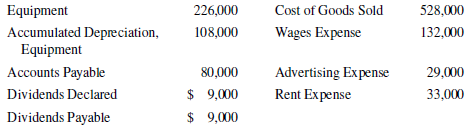

West Coast Recycling Ltd. (WRCL) is a Nanaimo, British Columbia-based company specializing in the collection and reprocessing of glass and plastic drinking containers. The company also has a retail component, selling composting and recycling products. WRCL was founded in 2017 and has positioned itself as a leading company in its field. The company’s year end is January 31. WRCL had the following account balances at December 31, 2019:

WRCL had the following transactions during January 2020, the last month of WRCL’s fiscal year:

Jan. 1 WRCL purchased a new collection truck for $310,000, paying $110,000 cash and financing the balance using a note payable at 9% per annum. The note payable is due in 12 months, but interest on the note must be paid on the first day of every month. Management of WRCL has determined that the truck will have a useful life of five years and a residual value of $70,000.

1 WRCL paid $3,300 for an insurance policy on the new truck for the period January 1 to December 31, 2020.

5 The company purchased, on credit, compost bins for its inventory at a cost of $13,000.

12 Pinamalas University, one of WRCL’s largest customers, signed a new glass recycling contract with WRCL. The contract runs from February 1, 2020, to January 31, 2021. In accordance with the terms of the contact, Pinamalas paid WRCL $4,500, representing the first month’s fees under the contract.

18 Made $75,500 in sales of compost bins, of which one-third was on account and the balance was cash. The cost to WRCL of the bins sold was $52,100.

31 Recorded wages earned by employees during the month of $32,000, of which $26,000 were paid.

31 WRCL paid dividends in the amount of $9,000, which had been declared by the board (and recorded) in December 2019.

31 Paid $3,000 rent for the month of January 2020.

The company also needed to record adjusting entries for the following:

Jan. 31 Recorded the entry to recognize that supplies costing $2,300 remained on hand at the end of the month.

31 Recorded the entry related to its insurance expense for the policy on the new truck.

31 Recorded the entry related to the depreciation of its new truck.

31 Recorded the entry for depreciation of the equipment for the year in the amount of $60,000.

31 Recorded the entry related to the interest on the note payable.

31 Recorded the entry to recognize that $12,800 of the unearned revenue had been earned during the month.

Required

a. Prepare journal entries for the first eight transactions. Create new accounts as necessary.

b. Prepare the adjusting journal entries.

c. Set up T accounts, enter the beginning balances from 2019, post the 2020 entries, and calculate the balance in each account.

d. Prepare a trial balance, and ensure that the total of the debit balances is equal to the total of the credit balances.

e. Prepare a statement of income for 2020.

f. Prepare the closing entries, post them to the T accounts, and calculate the final balance in each account.

g. Prepare a statement of financial position at January 31, 2020.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley