19. The Risk-Less Company uses the certainty-equivalent approach to adjust for the project risk. It is considering

Question:

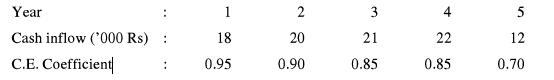

19. The Risk-Less Company uses the certainty-equivalent approach to adjust for the project risk. It is considering a project which requires an initial outlay of Rs 64,000 with a useful life of 5 years, and no salvage value thereafter. The expected cash flows and their certainty equivalent coefficients are as follows:

Using a discount rate of 12%, compute the risk-adjusted net present value of the investment project.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: