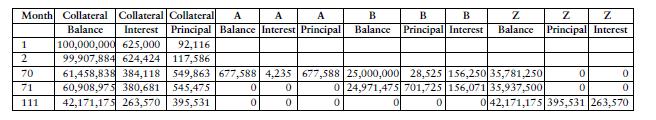

Given the following mortgage collateral and sequential-pay CMO: Mortgage collateral = $100,000,000 Weighted average coupon rate (WAC)

Question:

Given the following mortgage collateral and sequential-pay CMO:

Mortgage collateral = $100,000,000

Weighted average coupon rate (WAC) = 8%

Weighted average maturity (WAM) = 360 months

Estimated prepayment speed = 150 PSA

MBS pass-through rate = PT rate = 7.5%

Tranche A receives all principal payment from the collateral until its principal of $50 million is retired.

Tranche B receives its principal of $25 million after A’s principal is paid.

Tranche B receives interest each period equal to its stated coupon rate of 7.5% times its outstanding balance at the beginning of each month.

Tranche Z is an accrual bond that receives its principal of $25 million after B’s principal is paid

a. Complete the table:

b. Suppose the CMO has a PT rate of 7% on Tranche A, a PT rate of 6.5%

on Tranche B (Tranche Z’s rate stays at 7.5%), and a notional principal tranche. What would Tranche A’s and B’s interest receipts be in the first month? What would the notional principal tranche’s cash flow be in the first month? What would be the quoted principal on the notional principal tranche?

Step by Step Answer: