Given the following spot rates on one-year to four-year zero-coupon bonds: a. What is the equilibrium price

Question:

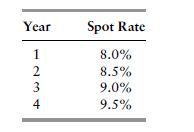

Given the following spot rates on one-year to four-year zero-coupon bonds:

a. What is the equilibrium price of a four-year, 9% coupon bond paying a principal of $100 at maturity and coupons annually?

b. If the market prices the four-year bond such that it yields 10%, what is the bond’s market price?

c. What would arbitrageurs do given the prices you determined in

(a) and (b)?

What impact would their actions have on the market price?

d. What would arbitrageurs do if the market price exceeded the equilibrium price? What impact would their actions have on the market price?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: