In January, the OBrien Development Company closed a deal with local officials to develop a new office

Question:

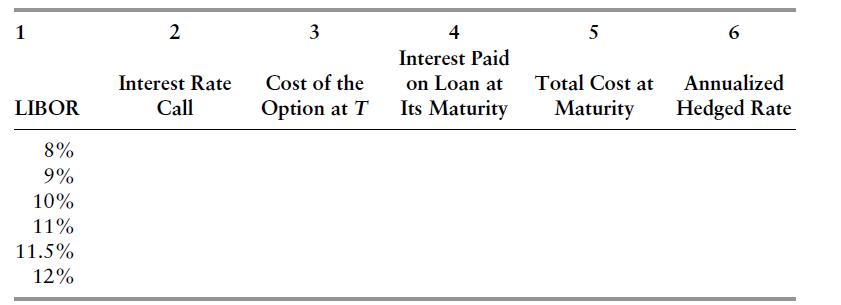

In January, the O’Brien Development Company closed a deal with local officials to develop a new office building. The project is expected to begin in June and take 270 days to complete. The cost of the development is expected to be $32 million, with the Western Southern Insurance Company providing the permanent financing of the development once the construction is completed. O’Brien Development has obtained a 270-day construction loan from the Reinhart Financial Company. Reinhart Financing will disburse funds to O’Brien at the beginning of the project in June, with the interest rate on the loan being set equal to the LIBOR plus 150 bp. The principal and interest on the loan are to be paid at maturity. Reinhart Financial is also willing to sell O’Brien an interest rate call with the following terms:

Exercise rate of 10%

Payoff at the maturity of the loan

LIBOR reference rate

Time period of 270 days or .75 per year

Notional principal of $32 million

Expiration at the June start of the loan

Cost of the caplet is $150,000 Using the table below, determine O’Brien’s hedged loan rate for possible LIBORs at the June date of 8%, 9%, 10%, 11%, 11.5%, and 12%.

Step by Step Answer: