In the table below, the IMM index prices on three T-bill futures contracts with expirations of 91,

Question:

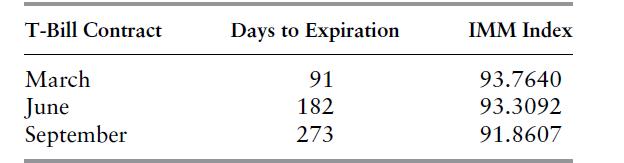

In the table below, the IMM index prices on three T-bill futures contracts with expirations of 91, 182, and 273 days are shown.

a. Calculate the actual futures prices and the YTMs (annualized) on the futures.

b. Given the spot 182-day T-bill is trading at annualized YTM of 6.25%, what is the implied 91-day repo rate?

c. If the carrying cost model holds, what would be the price of a 91-day spot T-bill?

d. What would be the equilibrium price on the March contract if the actual 91-day repo rate were 4.75%? What strategy would an arbitrageur pursue if the IMM index price were at 93.764?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: