In this chapter, I argued that the best choice for a loan is the loan with the

Question:

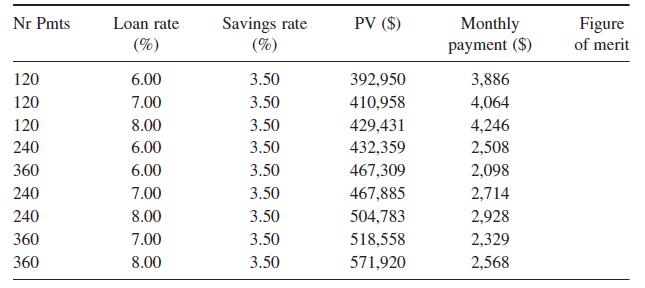

In this chapter, I argued that the best choice for a loan is the loan with the lowest present value, subject to the constraint that you have to be able to afford the payments. We could consider a fi gure of merit (FM) for a loan as the product of the present value and the monthly payment — when both of these factors are low, the FM will be low; when both are high, the FM will be high; and intermediate cases will fall somewhere in between.

Using the data in Table 8.2 , calculate the FM for each loan and discuss whether or not this FM defi nition is good.

In the table, I got the FMs by multiplying the PV by the Monthly Payment and then dividing by 10,000,000. These divisions don ’ t change the relative values of the FMs, but they do make it a lot easier to read the signifi cant fi gures of the numbers without getting distracted by all of the digits .

Step by Step Answer:

Understanding The Mathematics Of Personal Finance An Introduction To Financial Literacy

ISBN: 9780470497807

1st Edition

Authors: Lawrence N. Dworsky