A 2 -year semiannual coupon bond is issued on (1 / 1 / 2020) and matures on

Question:

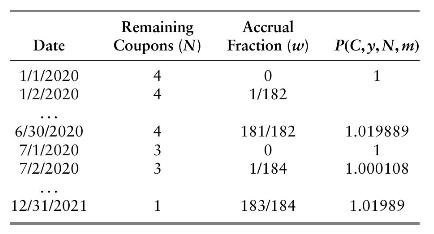

A 2 -year semiannual coupon bond is issued on \(1 / 1 / 2020\) and matures on \(1 / 1 / 2022\) with a semiannual coupon rate of \(4 \%\) per annum and coupon dates 7/1/2020, 1/1/2021, 7/1/2021, 1/1/2022, leading to four coupon periods consisting of \(182,184,181\), and 184 days, respectively.

(a) Keeping its semiannual yield constant at \(4 \%\), graph the daily price from 1/1/2020 to 12/31/2021, using Act/Act for fractional periods. The price ramps up from 1/1/2020 to 6/30/2020 and drops (almost \(2 \%)\) from 6/30/2020 to 7/1/2020 with no change in yields. The drop is simply due to one fewer remaining coupons.

(b) Graph the clean and dirty price of the bond from 1/1/2020 to \(12 / 31 / 2021\) when its yield is held at \(5 \%\), resulting in a discount bond, \(C

(c) Graph the clean and dirty price of the bond from 1/1/2020 to \(12 / 31 / 2021\) when its yield is held at \(3 \%\), resulting in a premium bond, \(C>y\).

Step by Step Answer:

Mathematical Techniques In Finance An Introduction Wiley Finance

ISBN: 9781119838401

1st Edition

Authors: Amir Sadr