Using the example in Figure 7.7 and the results in Table 7.5 (a) Show the computations for

Question:

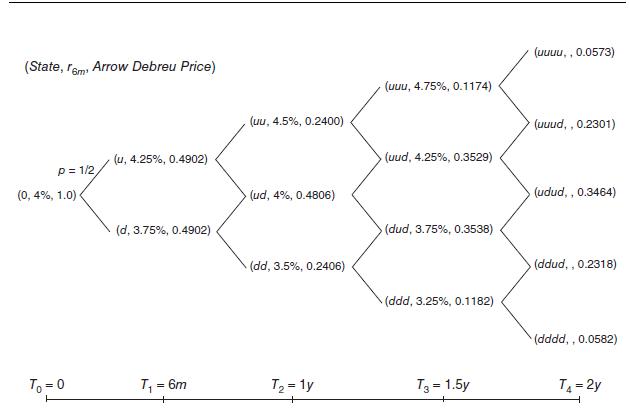

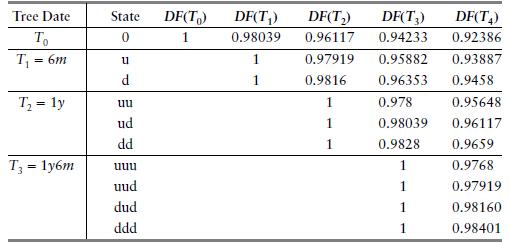

Using the example in Figure 7.7 and the results in Table 7.5

(a) Show the computations for the \(T_{1}\) discount factor curves in each of the \((u, d)\) states starting from the \(T_{2}\) discount factor curves.

(b) Show the computation for the Arrow-Debreu prices of the three \(T_{2}\) states \((u u, u

d, d d)\) from the \(T_{1}\) AD prices.

(c) Calculate the semiannual 1-year CMS (par swap) rate in each of the \((u, d)\) states at \(T_{1}\).

(d) Calculate today's value of a \(\$ 1 \mathrm{M}\) European-style 6 month into 1-year payer swaption with semiannual fixed rate of \(4 \%\) per annum.

Figure 7.7

Table 7.5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Mathematical Techniques In Finance An Introduction Wiley Finance

ISBN: 9781119838401

1st Edition

Authors: Amir Sadr

Question Posted: