Question

You work as an engineer at AICOIN Inc. The company asks you to evaluate the profitability of a wind power project in which it

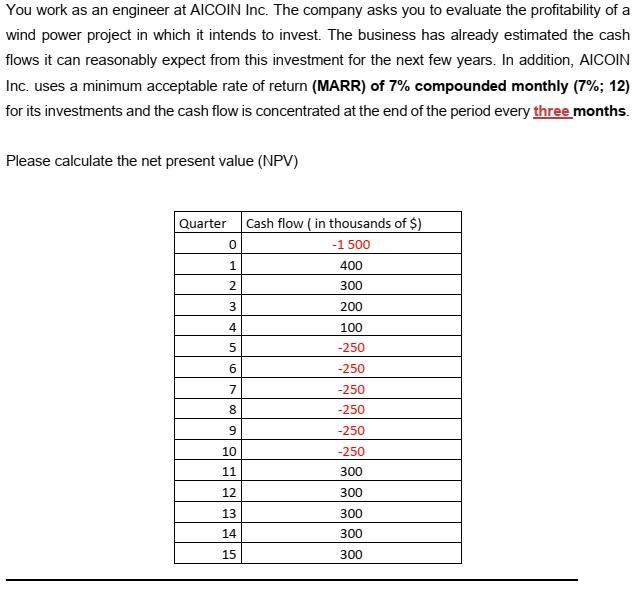

You work as an engineer at AICOIN Inc. The company asks you to evaluate the profitability of a wind power project in which it intends to invest. The business has already estimated the cash flows it can reasonably expect from this investment for the next few years. In addition, AICOIN Inc. uses a minimum acceptable rate of return (MARR) of 7% compounded monthly (7%; 12) for its investments and the cash flow is concentrated at the end of the period every three months. Please calculate the net present value (NPV) Quarter Cash flow (in thousands of $) -1 500 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 400 300 200 100 -250 -250 -250 -250 -250 -250 300 300 300 300 300

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Project Management The Managerial Process

Authors: Erik Larson, Clifford Gray

6th edition

1259186407, 978-0078096594, 78096596, 978-1259186400

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App