Suppose you expect to need a new plant that will be ready to produce turbo-encabulators in 36

Question:

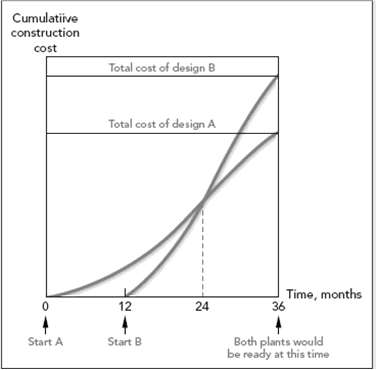

Suppose you expect to need a new plant that will be ready to produce turbo-encabulators in 36 months. If design A is chosen, construction must begin immediately. Design B is more expensive, but you can wait 12 months before breaking ground. Figure shows the cumulative present value of construction costs for the two designs up to the 36-month deadline. Assume that the designs, once built, will be equally efficient and have equal production capacity.

A standard discounted-cash-flow analysis ranks design A ahead of design B. But suppose the demand for turbo-encabulators falls and the new factory is not needed; then, as Figure 22.8 shows, the firm is better off with design B, provided the project is abandoned before month 24.

Describe this situation as the choice between two (complex) call options. Then describe the same situation in terms of (complex) abandonment options. The two descriptions should imply identical payoffs, given optimal exercisestrategies.

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers