Go back

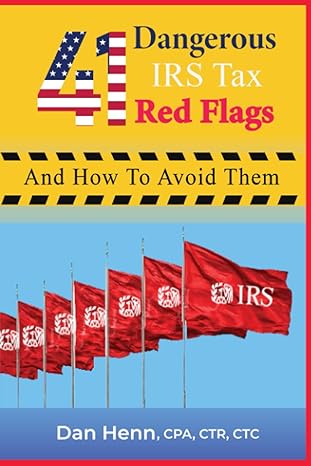

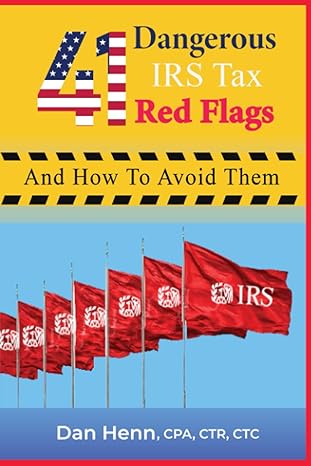

41 Dangerous Irs Tax Red Flags And How To Avoid Them(1st Edition)

Authors:

Dan Henn

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $24.99

Savings: $24.99(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for 41 Dangerous Irs Tax Red Flags And How To Avoid Them

Price:

$9.99

/month

Book details

ISBN: 979-8536113974

Book publisher: Independently published (July 13, 2021)

Get your hands on the best-selling book 41 Dangerous Irs Tax Red Flags And How To Avoid Them 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: The IRS is one of the most feared and hated agencies of the federal government. They have built that reputation over years of ruthless review and denial of taxpayer's tax return deductions and the documentation (or lack thereof) they provide. Congress has knocked the IRS down a peg or two with some new legislation over the last few decades, but they still continue to relentlessly pursue the tax rule breaker.Many people receive IRS notices and panic when they get them. Do yourself a favor and try to file the return the right way the first time and reduce your chances of receiving an IRS notice or even minimize your chances of winning the IRS audit lottery.This book will explain how the IRS selects many returns for audit along with 41 different tax errors or goofs that people make every year and keep you from being a bigger target for an IRS audit.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Tammy graham

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."