Go back

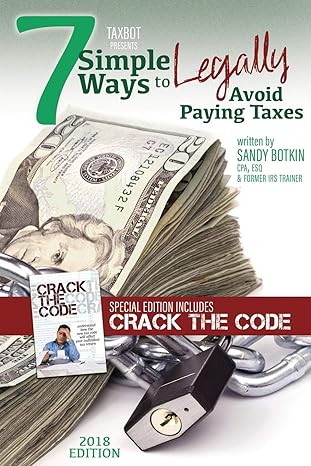

7 Simple Ways To Legally Avoid Paying Taxes(2018 Edition)

Authors:

Sandy Botkin

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $275.00

Savings: $275(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for 7 Simple Ways To Legally Avoid Paying Taxes

Price:

$9.99

/month

Book details

ISBN: 173101483X, 978-1731014832

Book publisher: Independently published

Get your hands on the best-selling book 7 Simple Ways To Legally Avoid Paying Taxes 2018 Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: This special edition includes "Crack the Code". Which covers how the Tax Cuts & Jobs Act can benefit your personal taxes.At it's inception, the tax law was 30 words. That's right, 30 words! It has ballooned over the years to over 70,000 pages. Recently, the House and Senate passed a series of sweeping changes to the tax laws. These were meant to make the laws less complicated. Which is great. But when you're taking something that is massively complicated, and making it less complicated, you still end up in one place… complicated.Sandy Botkin is a certified public accountant (CPA) and former IRS trainer. He has dedicated the better part of his life to helping people better understand the tax laws. To making sure that everyone takes advantage of every deduction to which they are legally allowed.Yes, your accountant or tax preparer handles that for you. But, are they finding every deduction? Or are they simply inputing what you give them and filing the forms? You need to know the best deductions to take for your business.This handbook, "7 Simple Ways to Legally Avoid Paying Taxes: Special Edition", gives you an easy-to-understand guide covering the most overlooked deductions. Plus, Sandy takes you through how best to avoid an audit. More importantly, the steps you need to take should that dreaded audit letter arrive in your mailbox.Previously available under the title "7 Simple Ways to Navigate the New Tax Laws for the Self-Employed".

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Kristopher Lucas

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."