Go back

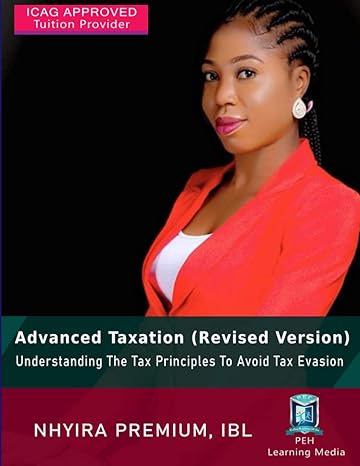

Advanced Taxation Understanding Tax Principles To Avoid Tax Evasion(1st Edition)

Authors:

Nhyira Premium IBL

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $9.00

Savings: $9(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Advanced Taxation Understanding Tax Principles To Avoid Tax Evasion

Price:

$9.99

/month

Book details

ISBN: 979-8694832625

Book publisher: Independently published

Get your hands on the best-selling book Advanced Taxation Understanding Tax Principles To Avoid Tax Evasion 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: This book contains not just what is required for every student writing the Principles of Taxation or the Advanced Taxation examinations of the Institute of Chartered Accountants – Ghana’s professional qualification programme, instead, you get the practical principles on Taxation in Ghana. In this revised version, you will learn in details principles of the following: •Ghana Tax System•Tax Administration in Ghana•Income Tax and Corporate Tax Liabilities•Value Added Tax (VAT)•Withholding Tax •Standard Tax Planning•The 3 – Tier Pension Scheme •Fiscal Policy •Taxation of Petroleum & Mineral and Mining Operations •Among others. Certainly, this book can be used by both students as well as Business Professionals to broaden their understanding on the Tax System in Ghana and most importantly how companies and individuals can effectively plan their taxes in order not to invade tax.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

News newdays

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."