Go back

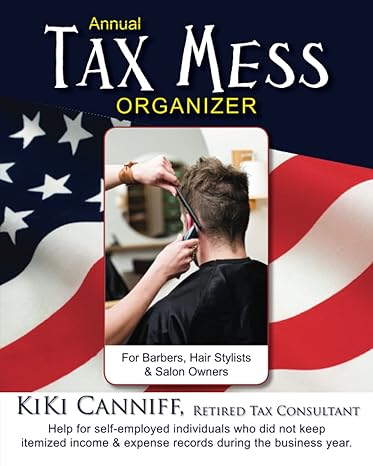

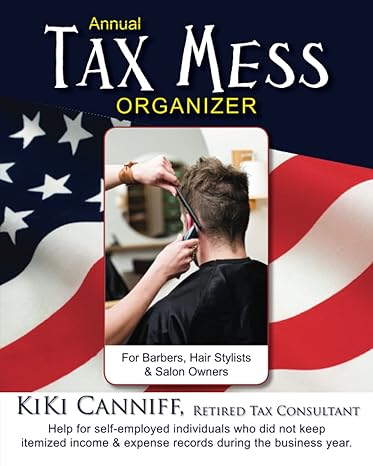

Annual Tax Mess Organizer For Barbers Hair Stylists And Salon Owners Help For Help For Self Employed Individuals Who Did Not Keep Itemized Income And During The Business Year(1st Edition)

Authors:

KiKi Canniff

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $16.95

Savings: $16.95(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Annual Tax Mess Organizer For Barbers Hair Stylists And Salon Owners Help For Help For Self Employed Individuals Who Did Not Keep Itemized Income And During The Business Year

Price:

$9.99

/month

Book details

ISBN: 0941361705, 978-0941361705

Book publisher: One More Press (January 7, 2016)

Get your hands on the best-selling book Annual Tax Mess Organizer For Barbers Hair Stylists And Salon Owners Help For Help For Self Employed Individuals Who Did Not Keep Itemized Income And During The Business Year 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: Updated as needed. Tax rules seldom change much. (Last updated 2021)Anyone can do their own business taxes and save money!.Keep your business private and off the computer. Control your financial information.. Easy to use..Includes step by step directions and tells you what to deduct!.FOUR HOURS TO TAX FRENZY FREEDOM!When April 15th gets close, self-employed hair care people all across the United States go into tax frenzy. These independent contractors become unnecessarily stressed out, putting their business on hold, while they deal with a disorganized pile of receipts and paperwork that sits between them and an audit-proof tax return.This ANNUAL TAX MESS ORGANIZER explains how to get on top of that paperwork quickly, allowing you to satisfy the IRS and get back to work in four hours or less. All you need to make the organizer work is the organizational forms included in this book, 25 large envelopes, an adding machine and an empty table or desk top.Step by step, this book shows you how to sort your own receipts•Understand what the IRS expects•Organize information for you or your tax preparer. The examples in this ANNUAL TAX MESS ORGANIZER will work for all hair care professions. It includes a variety of examples and situations that can be applied to all types of self-employment situations.The author has also written a number of other industry-specific organizers; those contain examples and situations pertaining only to that particular industry. For those who have always prepared their own personal tax return, there is a chapter on how to fill out the small business Schedule C. Self employment taxes, 1040 entries, and other deductions available to the independent contractor are also explained.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Lorissa Talavera

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."