Go back

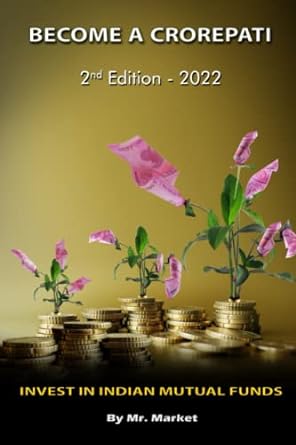

Become A Crorepati Invest In Indian Mutual Funds(2nd Edition)

Authors:

Mr Market

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $10.00

Savings: $10(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Become A Crorepati Invest In Indian Mutual Funds

Price:

$9.99

/month

Book details

ISBN: 979-8423115166

Book publisher: Independently published (March 7, 2022)

Get your hands on the best-selling book Become A Crorepati Invest In Indian Mutual Funds 2nd Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: What will you find in this book?When you become wealthy or wealthier, you can make your life more comfortable. You can help the needy and the downtrodden. I have written about the past richness of India and what happened in the past few centuries. When Christ was born India was the richest country in the world followed by China. Its riches were robbed when it became a colony in the 1800s. Then I explain what a mutual fund is. A mutual fund is a company that pools money from the investors and invest and manage the money for them.Why should one invest in Indian mutual funds? Indians are smart and hard working. It is democracy with full freedom. Indians are highly educated. Indian economy is expected to grow at a pace of 8 to 9% annually. As the middle class is growing fast, the demand for goods domestically is high. So, manufacturing and businesses will keep growing for decades to come.Indian mutual fund managers have shown their might in the past few decades. They are excellent. When I reviewed, I found 5 top equity funds with an annual growth of around 25% over the last 5year period. The top equity fund, Quant Small Cap Diversified Equity Fund has grown 87.66% in one year, 38.11% in 3 years and 23.26% in one year! Superb!You do not pay any fee for buying this fund. The initial minimum investment is Rs. 5000. If you redeem the money before the end of one year you pay 1% fee on the amount withdrawn. As you are going to invest for retirement, this is not an issue. When you retire and start withdrawing, you have to pay long term capital gains tax. Currently the tax is 10%. Long term is more than one year.I have given A SIMPLE YET VERY POWERFUL METHOD of investing in mutual funds in India. This is the method I have been using for many years with phenomenal results. I have explained the magic of compounding by giving a true story from India. The trick to become wealthy, is to start at a very early age. Because of the beauty of compounding, the results will be unbelievable. Let us say that you start investing at age 30, Rs1000 per month, and it grows at 25% a year, at 65 you will have Rs14786142 (nearly 1.5 crores)! This is like magic. I used http://www.moneychimp.com for the compound interest rate calculation. The final results will depend on the age you start investing at and for how long and the amount invested and the growth rate. If you invest more money monthly, you will have lot more money on retirement.This is a simple way to create a lot of wealth. Let the mutual fund managers do all the work and make money for you. The time is ripe for investing in Indian mutual funds, as India is at the top globally with regards to growth.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Request kn2qf0b

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."