Go back

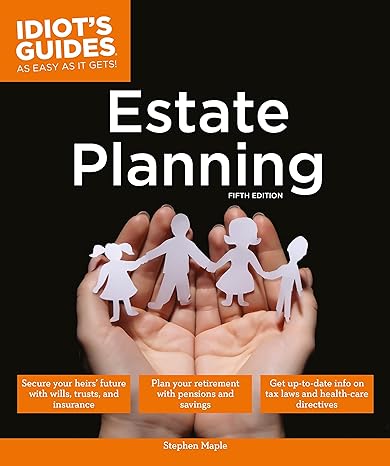

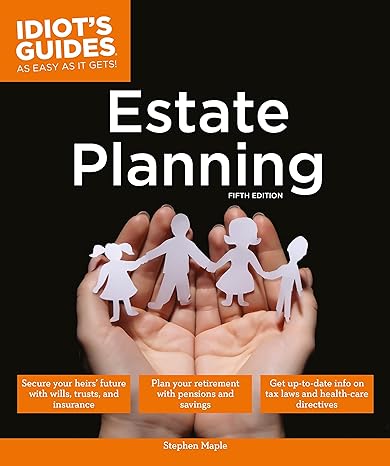

Estate Planning 5e(5th Edition)

Authors:

Stephen Maple

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $10.92

Savings: $10.92(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Estate Planning 5e

Price:

$9.99

/month

Book details

ISBN: 1615648976, 978-1615648979

Book publisher: Alpha

Get your hands on the best-selling book Estate Planning 5e 5th Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: Anyone with assets and heirs needs a will to determine what will happen to their property and plan for the welfare of their children should they pass away unexpectedly. As people age, they tend to think more seriously about having a will and planning their estates, to help their heirs, and to give them the maximum amount of money possible. This book makes it easy to understand all the issues surrounding estates, and to draft a will. This book covers: • An introduction to the important concepts of estate planning and vital information on how to get started on a plan. • Valuing your property and assets, including businesses and self-employment issues. • Getting the most from life insurance, pensions, and retirement savings. • Creating a will and trusts, and learning how probate works. • Looking after minor children in the event of your death, planning for special situations such as divorce and bankruptcy, and avoiding family feuds over inheritance. • Everything you need to know about taxes: estate, gift, state and federal income—and how to ensure that your heirs receive the assets you have intended for them. • Planning for retirement, including Social Security benefits, power of attorney, and health care directives.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Jon Doe

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."