Go back

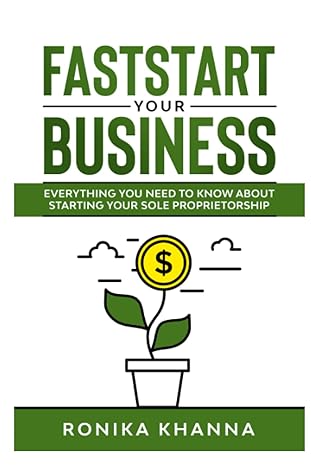

Faststart Your Business Everything You Need To Know About Starting Your Canadian Based Sole Proprietorship(1st Edition)

Authors:

Ronika Khanna

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $19.99

Savings: $19.99(100%)

Book details

ISBN: 177744392X, 978-1777443924

Book publisher: Independent Publisher (May 4, 2021)

Get your hands on the best-selling book Faststart Your Business Everything You Need To Know About Starting Your Canadian Based Sole Proprietorship 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: Is your goal to own and operate a Canadian small business or transition to self employment?FASTSTART Your Business is the quintessential guide to eliminating unnecessary stress, focusing on what matters most, and setting yourself up for long term success.Inside, you’ll discover:Step by step framework on what you need to do as a sole proprietor and how to build a strong foundationWhy most new businesses need to register and guidance on how to do it in every province.What every business owner needs to know about sales tax (GST/HST and QST) , how to register and how to save money with the Quick Method.What you need to know about hiring employees and how setting it up is easier than you think.How to reduce taxes by reviewing the types of expenses that are deductible for small businesses and insights on preparing your income tax return even if you outsource it to an accountant.How much you need to save in taxes so that you can be prepared and avoid unpleasant surprises when you do your tax return.The different types of business structures and whether a sole proprietorship or a corporation is best for your situation.And much more!Learn everything you need to know, including strategies for success, methodologies that will make your life easier, and which tools to use from author Ronika Khanna CPA, CA, CFA and get your business up and running fast.Includes complimentary PDF version with proof of purchaseTypes of businesses that will benefit from this book include: Anyone starting their own business or transitioning to self employment.Freelancers, independent contractors and self employed individuals who have started to see growth in their businessExisting business owners who want to make sure that they are following the right path with respect to their registration, accounting and taxThose who are either thinking of starting or already have a part time gig such as web developers, ebay sellers, writers/bloggers, course creators etc.CUSTOMER REVIEWS: I think it's essential reading for any Canadian/Quebecer small business person who wants clear, straightforward, no "BS" answers to every question you have (and many you haven't thought about) about starting a sole proprietorship. The book is written in layman's terms so pretty much anyone can understand it, And since each chapter title answers a question about sole proprietorship you can skip around the book as you like without wondering if you missed something. Highly recommend for Canadian entrepreneurs in every province!Ronika's book provides great insight which allowed me to understand the process of starting a business in Quebec. It is very informative and well organized, as the information provided can be difficult to find elsewhere and let alone in one resource. I highly recommend reading through this book if you are starting a business in Quebec or in Canada!FastStart Your Business includes the following topics:Guidance on registering your business in each province.Should you register for sales taxes (HST/GST and QST) , how to do it and how to save.Why every business owner needs a separate bank account.Should you do your own accounting?How to pay yourself and employeesHow to invoice your clientsWhat type of taxes are deductible and how to file your taxes? .And more...Bonus chapters include:Should you incorporate your business?Detailed instructions on how to register your business in QuebecHow to pay your HST/GST and QST using online bankingGuidance on PST in different provinces

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Karl Wanke

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."