Go back

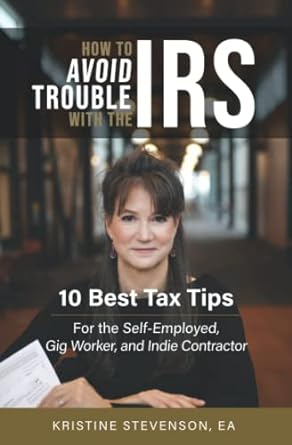

How To Avoid Trouble With The IRS 10 Best Tax Tips For The Self Employed Gig Worker And Indie Contractor(1st Edition)

Authors:

Kristine Stevenson EA

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $12.99

Savings: $12.99(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for How To Avoid Trouble With The IRS 10 Best Tax Tips For The Self Employed Gig Worker And Indie Contractor

Price:

$9.99

/month

Book details

ISBN: 979-8985491401

Book publisher: Ma Pig Publishing

Get your hands on the best-selling book How To Avoid Trouble With The IRS 10 Best Tax Tips For The Self Employed Gig Worker And Indie Contractor 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: If you are self-employed or part of the gig economy, or work as an independent contractor, avoid trouble with the IRS by implementing these 10 best tax tips.Many (newly) self-employed people are confused about what self-employment tax is, and how and when it's supposed to be paid. If that's you, this is the book you need. At just over 100 pages, inside this book is the basic tax information every self-employed person needs to know and wished they had. For instance, if you implement Tax Tips #4 and #7, you will learn how easy it is to set aside money to pay self-employment tax to the IRS!!This book is a quick read, easy to understand and has action steps to guide you. No IRS jargon or complicated tax stuff to figure out, just practical steps in plain english, and real life client stories and examples throughout.Based on over five years’ experience working at the IRS talking directly with thousands of self-employed people just like you, plus her work in the tax resolution industry today, Kristine Stevenson, EA gives you the rock-bottom basics of the tax information you need to have, right from the start, if you are self-employed. Thousands of self-employed people fail to pay their (self-employment) tax every year due to lack of available money, fear, or knowledge of what to do. By implementing the basic systems this books lays out, you can avoid all of that. This information isn't taught in business schools, and most people aren't going to read the IRS publications to find it. Many self-employed test readers of this book commented, "I wish I knew this when I started!"By setting up simple systems at the beginning of your self-employment, or even implementing them now if you've been self-employed for awhile, you can avoid tax problems with the IRS, and easily stay in compliance. If you're already in substantial debt to the IRS and need help, you can contact the author directly with information found inside this book.These 10 best tax tips are simple, straightforward action steps you can begin using TODAY. Tax Tip #2 takes only 10 minutes to complete! They've been tested by thousands and they work. By implementing even a few of these tips, you could end up saving yourself painful headaches with the IRS, hundreds of dollars in penalties, and thousands of dollars in tax come tax time.By implementing the strategies in this book you will:Learn what co-mingling of money is, and how to avoid it!Understand if you can use your Social Security Number (SSN) or if you need an Employer Identification Number (EIN) for your business.Discover the best and easiest way to send money to the IRS.Learn that by saving just a little money every month - you will have money set aside to pay your taxes!Understand why and how to track income and expenses.Have access to dozens of useful links, lists, and information all in one little book...And more!Paying tax does not have to be complicated, even if it feels like it is. You don’t need to get stressed out at tax time or worry about how you’ll pay the IRS if you're self-employed, and this little book will show you how!!

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Edmundo Zevallos

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."