Go back

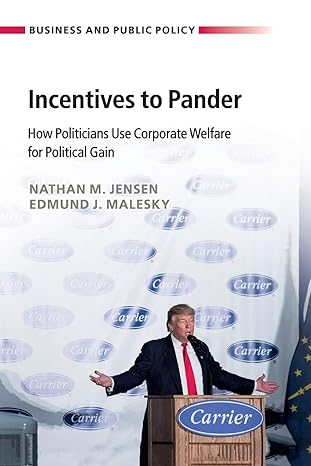

Incentives To Pander How Politicians Use Corporate Welfare For Political Gain(1st Edition)

Authors:

Nathan M. Jensen ,Edmund J. Malesky

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $35.99

Savings: $35.99(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Incentives To Pander How Politicians Use Corporate Welfare For Political Gain

Price:

$9.99

/month

Book details

ISBN: 1108408532, 978-1108408530

Book publisher: Cambridge University Press

Get your hands on the best-selling book Incentives To Pander How Politicians Use Corporate Welfare For Political Gain 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: Policies targeting individual companies for economic development incentives, such as tax holidays and abatements, are generally seen as inefficient, economically costly, and distortionary. Despite this evidence, politicians still choose to use these policies to claim credit for attracting investment. Thus, while fiscal incentives are economically inefficient, they pose an effective pandering strategy for politicians. Using original surveys of voters in the United States, Canada and the United Kingdom, as well as data on incentive use by politicians in the US, Vietnam and Russia, this book provides compelling evidence for the use of fiscal incentives for political gain and shows how such pandering appears to be associated with growing economic inequality. As national and subnational governments surrender valuable tax revenue to attract businesses in the vain hope of long-term economic growth, they are left with fiscal shortfalls that have been filled through regressive sales taxes, police fines and penalties, and cuts to public education.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Request tih5jq0

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."