Go back

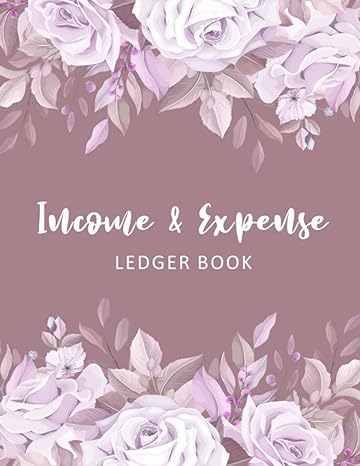

Income And Expense Ledger Book(1st Edition)

Authors:

Bookkeeping Tracker Press

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $5.95

Savings: $5.95(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Income And Expense Ledger Book

Price:

$9.99

/month

Book details

ISBN: 979-8427520010

Book publisher: Independently published (March 8, 2022)

Get your hands on the best-selling book Income And Expense Ledger Book 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: This Ledger book is great for tracking finances and transactions. It can be used for personal, small business, or home-based businesses. This book includes the date, description, account, income, expenses, and Totals.Features & Details:Finance Notebook: Manage and organize your personal finances, savings, debts, and bills with this simple budget planner notebook.Undated Journal: Each sheet in our undated expense journal has a sizeable amount of space for you to track transaction type, date, description, account, payment, deposit, and total.Reliable Quality: The expense book sheets have smooth, double-sided paper - allows you to easily write details from recent transactions in your checking or savings account.Dimensions: Each accounting notebook measures 8.5 x 11 inches; perfectly sized to fit into your backpack or laptop bag.High gloss cover.2,900 entry lines total ( 29 lines per page x 100 pages per register!!!)

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Varunan Asokan

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."