Go back

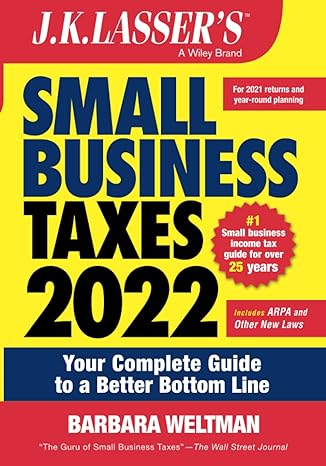

J K Lassers Small Business Taxes 2022 Your Complete Guide To A Better Bottom Line(2020 Edition)

Authors:

Barbara Weltman

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $23.95

Savings: $23.95(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for J K Lassers Small Business Taxes 2022 Your Complete Guide To A Better Bottom Line

Price:

$9.99

/month

Book details

ISBN: 1119838584, 978-1119838586

Book publisher: Wiley

Get your hands on the best-selling book J K Lassers Small Business Taxes 2022 Your Complete Guide To A Better Bottom Line 2020 Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: A complete guide to taxes for small businesses, brought to you by the leading name in taxesThe over 30 million small businesses in America are the essential backbone of the American marketplace. J.K. Lasser's Small Business Taxes 2022: Your Complete Guide to a Better Bottom Line helps owners save as much as possible on taxes. If you own a small business, this comprehensive guide provides a pathway to quickly determine your tax liability and what kind of tax relief is available to you, down to the nitty gritty?even going so far as to show where to claim deductions on the IRS forms. Barbara Weltman brings her expertise to this topic, as a nationally recognized specialist in taxation for small businesses. Filled with tax facts and planning strategies, this guidebook is the ideal tool to help small business owners make business decisions on a tax-advantaged basis. Small Business Taxes 2022 also provides readers with: A complete listing of the available business expense deductions and tax credits, plus what's needed to qualify for themThe most up-to-date information on current tax law and procedures, including information on the American Rescue Plan Act (ARPA) and the Consolidated Appropriations Act, 2021 (CAA)A heads up on changes ahead to optimize tax planningSample forms and checklists to help you get organized and prepare you to submit the most complete and proper filingSmall Business Taxes 2022 uses concise and plain English to help provide small business owners and their advisers a detailed overview on the tax rules they need to know.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Request g1mlj07

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."