Go back

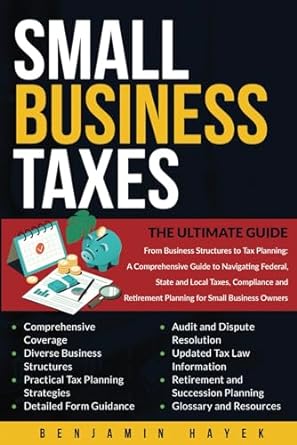

Small Business Taxes The Ultimate Guide(1st Edition)

Authors:

Benjamin Hayek

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $14.99

Savings: $14.99(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Small Business Taxes The Ultimate Guide

Price:

$9.99

/month

Book details

ISBN: 979-8867920029

Book publisher: Independently published (November 16, 2023)

Get your hands on the best-selling book Small Business Taxes The Ultimate Guide 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: A Comprehensive Guide to Small Business TaxationWelcome to the definitive guide on small business taxation in the U.S. Whether you're a seasoned entrepreneur or just starting out, navigating the complexities of the U.S. tax system is pivotal to your business's success. This book is designed to demystify the intricate world of taxation, offering practical insights and actionable advice.Key Highlights:Historical Overview: Dive into the fascinating history of U.S. taxation, from its early roots to the modern-day system.Business Structures: Understand the tax implications of various business structures, from sole proprietorships to S-Corporations.Strategic Tax Planning: Learn how effective tax planning can minimize liabilities and boost your business's growth potential.Compliance & Reporting: Stay on top of your tax obligations with insights on compliance, reporting, and the importance of accurate record-keeping.Tax Audits & Disputes: Equip yourself with knowledge on the audit process and how to navigate disputes with the IRS.Staying Updated: Emphasize the importance of staying informed about tax law changes to ensure your business remains compliant.Retirement & Succession Planning: Delve into the significance of tax considerations in retirement and succession planning.This guide is not just about compliance; it's about strategy, planning, and making informed decisions that can significantly impact your bottom line. While it provides a wealth of knowledge, it's also a stepping stone to engage more effectively with tax professionals.Equip yourself with the knowledge to navigate the world of taxation confidently. Perfect for small business owners, financial advisors, and anyone keen on understanding the U.S. tax landscape.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Myriam Vanegas

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."