Go back

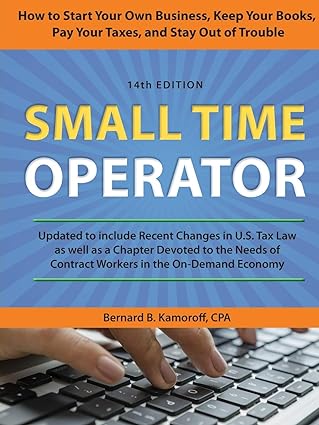

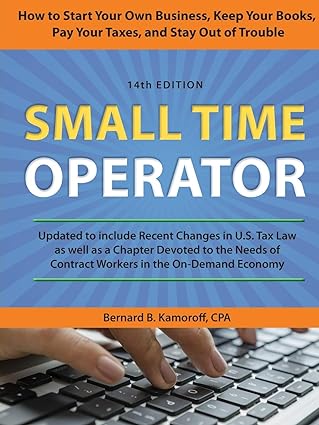

Small Time Operators Updated To Include Recent Changes In U.S. Tax Law As Well As A Chapter Devoted To The Needs Of Contracts Workers In The On Demand Company Operator How To Start Your Own Business Keep Your Books Pay Your Taxes And Stay Out Of Trouble(14th Edition)

Authors:

Bernard B. Kamoroff C.P.A.

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 10 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $13.17

Savings: $13.17(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 10 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Small Time Operators Updated To Include Recent Changes In U.S. Tax Law As Well As A Chapter Devoted To The Needs Of Contracts Workers In The On Demand Company Operator How To Start Your Own Business Keep Your Books Pay Your Taxes And Stay Out Of Trouble

Price:

$9.99

/month

Book details

ISBN: 163076261X, 978-1630762612

Book publisher: Taylor Trade Publishing

Get your hands on the best-selling book Small Time Operators Updated To Include Recent Changes In U.S. Tax Law As Well As A Chapter Devoted To The Needs Of Contracts Workers In The On Demand Company Operator How To Start Your Own Business Keep Your Books Pay Your Taxes And Stay Out Of Trouble 14th Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: Small Time Operator is one of the most popular business start-up guides ever. In clear, easy-to-understand language, the author covers:Getting permits and licensesHow to finance a businessCreating and using a business planChoosing and protecting a business nameDeciding whether to incorporateEstablishing a complete bookkeeping systemHiring employeesFederal, state, and local taxesBuying a business or franchiseDealing with—and avoiding—the IRSDoing business on the InternetHandling insurance, contracts, pricing, trademarks, and patentsIn this new edition, the book will feature a section on surviving the Global Information Grid or GIG economy. The on-demand economy, also known as the sharing economy or the gig economy, is a new and greatly expanding business model that is basically nothing more than a mobile app that connects people who need some type of service—a ride, a delivery, a plumber, a house cleaner—with individuals who provide that service. There are hundreds of thousands of newly self-employed individuals. Uber alone claims that they have 160,000 workers just in California. The great majority of these on demand workers have zero experience or knowledge about self-employment. This book will give on-demand workers everything they need to know about being self-employed.Bernard B. Kamoroff is a C.P.A. with over thirty years of experience specializing in small business. A University of California lecturer, he is the author of five books on business and taxes.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Alemzewd Sebsebie

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."