Go back

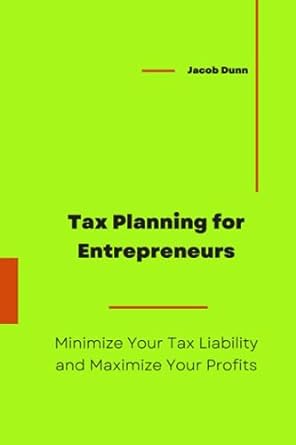

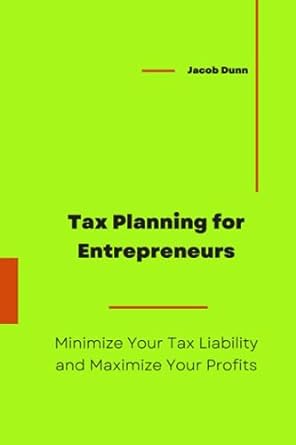

Tax Planning For Entrepreneurs Minimize Your Tax Liability And Maximize Your Profits(1st Edition)

Authors:

Jacob Dunn

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $70.00

Savings: $70(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Tax Planning For Entrepreneurs Minimize Your Tax Liability And Maximize Your Profits

Price:

$9.99

/month

Book details

ISBN: 979-8856226460

Book publisher: Independently published

Get your hands on the best-selling book Tax Planning For Entrepreneurs Minimize Your Tax Liability And Maximize Your Profits 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: Tax Planning for Entrepreneurs: Minimize Your Tax Liability and Maximize Your Profits is a comprehensive guide to understanding the complexities of tax planning for entrepreneurs. This book provides an in-depth look at the various tax strategies available to entrepreneurs, and how to use them to their advantage.The book begins by discussing the basics of taxation, including the different types of taxes, the different tax rates, and the various deductions available. It then dives into the specifics of tax planning for entrepreneurs, including the different types of business entities, the different types of income, and the different types of deductions. It also covers topics such as how to calculate taxes, how to minimize taxes, and how to maximize profits.The book also provides detailed information on how to use tax planning strategies to reduce taxes, such as taking advantage of deductions, credits, and other strategies. It also provides advice on how to choose the right business entity for tax purposes, and how to structure the business to maximize profits.The book also includes a section on tax planning for retirement, including strategies for setting up retirement accounts, minimizing taxes on retirement income, and maximizing returns on investments. It also provides information on how to use tax-advantaged investments to reduce taxes and increase returns.Finally, the book provides a comprehensive overview of the different types of taxes, including income taxes, payroll taxes, and estate taxes. It also provides advice on how to use tax planning strategies to minimize taxes and maximize profits.Tax Planning for Entrepreneurs: Minimize Your Tax Liability and Maximize Your Profits is an invaluable resource for entrepreneurs looking to maximize their profits and minimize their tax liability. It provides a comprehensive look at the different types of taxes, the different tax strategies available, and how to use them to their advantage. With this book, entrepreneurs can learn how to use tax planning strategies to reduce taxes and maximize profits.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Simon J. Martinez

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."