Go back

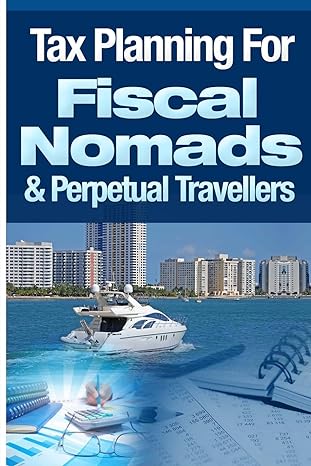

Tax Planning For Fiscal Nomads And Perpetual Travellers(1st Edition)

Authors:

Mr Lee Hadnum

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $14.73

Savings: $14.73(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Tax Planning For Fiscal Nomads And Perpetual Travellers

Price:

$9.99

/month

Book details

ISBN: 1495222306, 978-1495222306

Book publisher: CreateSpace Independent Publishing Platform

Get your hands on the best-selling book Tax Planning For Fiscal Nomads And Perpetual Travellers 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: Many people enjoy going on their summer holidays as a tourist in a foreign country. How would you fancy extending this 'holiday' permanently? It may not have been something you've previously thought of, but far from being a new or radical idea, there are many people who are already doing this, and depending on the nature of their investments, they are maintaining their capital and much of the returns on their investments without suffering taxes. These individuals are known by a variety of names including Fiscal Nomads, Perpetual Travellers and Cyber Gypsies. The basic principle is to exploit the residency rules in a number of countries so that you're not caught by any one country's tax net. Most people will do this by either travelling continuously or basing themselves in a handful of countries and only spending a few months in each. Providing care is taken as to the length of stay you could simply be treated as a tourist in each country and be exempted from any requirement to pay income tax. In this guide we look at how you can achieve this and the tax planning benefits and issues involved. Key issues covered include:Can you become a fiscal nomad? Do I need to establish residence overseas? Teleworking from home UK tax benefits for Fiscal Nomads Where to go? The top 2 residence schemes for Perpetual Travellers

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Margie jordan

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."