Go back

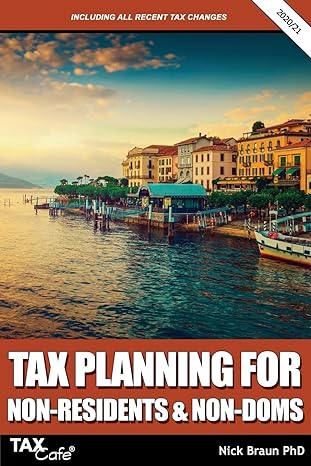

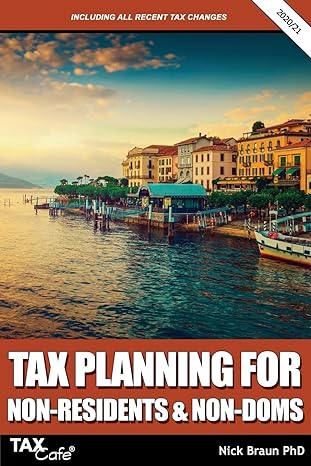

Tax Planning For Non Residents And Non Doms Including All Recent Tax Changes(2021 Edition)

Authors:

Nick Braun

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $32.95

Savings: $32.95(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Tax Planning For Non Residents And Non Doms Including All Recent Tax Changes

Price:

$9.99

/month

Book details

ISBN: 1911020609, 978-1911020608

Book publisher: Taxcafe UK Ltd

Get your hands on the best-selling book Tax Planning For Non Residents And Non Doms Including All Recent Tax Changes 2021 Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: Publication date: November 2020This unique tax guide shows you how to reduce your tax bill if you are non-UK resident or non-domiciled. This year's edition has been completely updated with changes announced by the Government and HMRC because of the coronavirus situation. Subjects covered include: All the latest tax changes affecting non-residents and non-domsHow the Statutory Residence Test works... with lots of examplesIncome tax planning for non-residents, including the tax treatment of rental income, employment income, dividends, pensions and interestCapital gains tax (CGT) planning for non-residents, including the special rules for those selling UK propertyThe temporary non-residence rules for those returning within 5 yearsHow double tax treaties can affect your tax positionCountries with low or zero income tax and capital gains taxHow to save tax when you retire abroad or work abroadHow non-domiciled individuals are taxed and how to work out where you are domiciled How non-doms can pay less income tax, capital gains tax and inheritance taxThe tax benefits of offshore trusts

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Cynthia Pritchard

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."