Go back

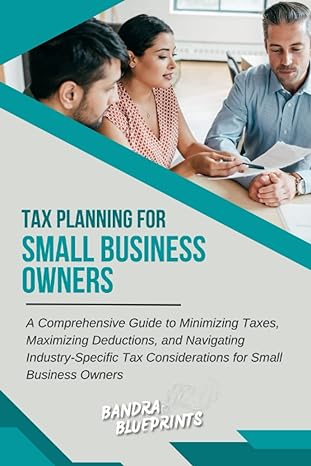

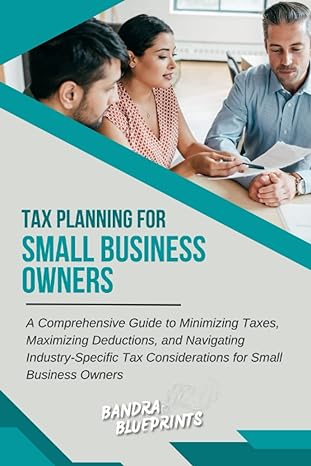

Tax Planning For Small Business Owners A Comprehensive Guide To Minimizing Taxes Maximizing Deductions And Navigating Industry Specific Tax Considerations For Small Business Owners(1st Edition)

Authors:

Bandra Blueprints

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $9.99

Savings: $9.99(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Tax Planning For Small Business Owners A Comprehensive Guide To Minimizing Taxes Maximizing Deductions And Navigating Industry Specific Tax Considerations For Small Business Owners

Price:

$9.99

/month

Book details

ISBN: 979-8396236943

Book publisher: Independently published

Get your hands on the best-selling book Tax Planning For Small Business Owners A Comprehensive Guide To Minimizing Taxes Maximizing Deductions And Navigating Industry Specific Tax Considerations For Small Business Owners 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: "Tax Planning for Small Business Owners: A Comprehensive Guide to Minimizing Taxes, Maximizing Deductions, and Navigating Industry-Specific Tax Considerations" is an essential resource for small business owners seeking to optimize their tax planning strategies.In this comprehensive guide, readers will discover practical and proven techniques to minimize their tax liabilities, maximize deductible expenses, and navigate the complex world of industry-specific tax considerations. From understanding the fundamentals of tax planning to exploring advanced strategies, this book provides a step-by-step roadmap for small business owners to effectively manage their tax obligations and retain more of their hard-earned profits.With a focus on practicality and real-world application, each chapter explores a specific aspect of tax planning, including entity structure optimization, retirement planning, expense deductions and credits, tax deferral strategies, and industry-specific tax considerations in sectors such as retail, hospitality, construction, professional services, and e-commerce.Written in accessible language, this guide demystifies complex tax concepts, offering clear explanations, insightful examples, and actionable advice. Small business owners will gain a deeper understanding of the tax implications associated with their business activities, enabling them to make informed financial decisions and develop effective tax strategies.Whether you're a sole proprietor, partnership, LLC, or corporation, this book equips you with the knowledge and tools necessary to navigate the ever-changing landscape of tax regulations. By leveraging the insights shared within these pages, you'll be able to proactively manage your tax obligations, identify potential tax savings, and ensure compliance with relevant tax laws.No matter your level of tax expertise, "Tax Planning for Small Business Owners" empowers you to take control of your tax situation and achieve financial success. Whether you're just starting your business or looking to optimize your current tax planning strategies, this comprehensive guide will be your trusted companion on the journey to tax optimization and financial prosperity.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Sara James

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."