Go back

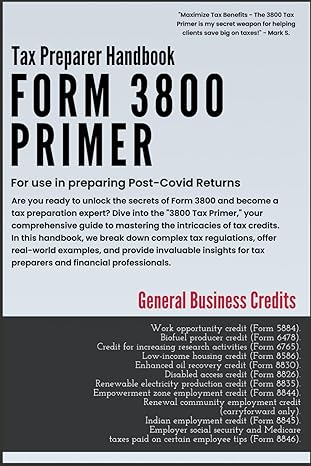

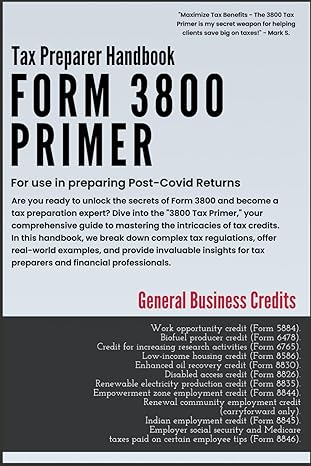

Tax Prepare Handbook Form 3800 Tax Credits And Primer For Use In Preparing Post Covid Returns(1st Edition)

Authors:

Larry Matthews Edition

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $29.99

Savings: $29.99(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Tax Prepare Handbook Form 3800 Tax Credits And Primer For Use In Preparing Post Covid Returns

Price:

$9.99

/month

Book details

ISBN: 979-8867086343

Book publisher: Independently published

Get your hands on the best-selling book Tax Prepare Handbook Form 3800 Tax Credits And Primer For Use In Preparing Post Covid Returns 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: This exhaustive guide is essential reading for accountants, CPAs, and tax professionals seeking to fully leverage Form 3800 General Business Credits to maximize savings for business clients. This definitive reference explores every available tax credit under the Form 3800 umbrella, unpacking eligibility requirements and calculation methodology in meticulous detail.Within these pages, you’ll discover insider strategies to identify often-overlooked credit opportunities, properly substantiate claims, and apply credits strategically to optimize tax savings. Whether you need nitty-gritty details on calculating the Work Opportunity Credit or qualifying major energy projects for the Investment Tax Credit, this book has you covered.Meticulously researched and packed with real-world examples, this handbook distills complex IRS rules into clear guidance. Learn how even small businesses can benefit from credits for childcare, pension plans, and disabled access improvements. Large corporations will uncover credits to offset research expenditures or invest in renewable energy and emerging technologies. Construction firms, manufacturers, hotels, and restaurants alike will find relevant incentives.This exhaustive guide leaves no stone unturned in uncovering every tax credit scenario, such as:- Securing credits for contractors rehabilitating historic buildings- Claiming incentives for employers providing paid family leave- Offsetting the high costs of orphan drug development- Maximizing benefits from the Low-Income Housing Tax Credit program- Substantiating R&D tax credits for software firms - Accelerating renewable energy adoption through biofuel producer creditsWith businesses facing continued uncertainty, securing every available tax credit is essential. This book provides the deep understanding required to capitalize on major savings while maintaining full IRS compliance. Whether you’re seeking credits for a client in a common industry or an obscure niche, the instructions within will have you covered. Maximize savings, empower clients, and strengthen your reputation as an expert by mastering business tax credits with this definitive guide.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Carl Jenkins

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."