Go back

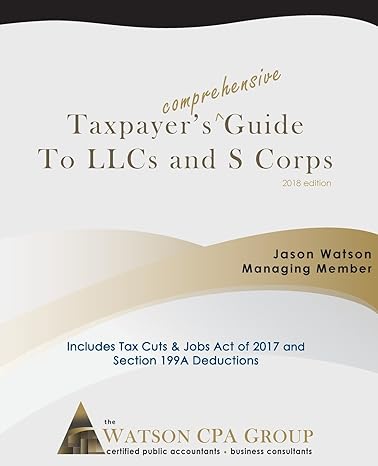

Taxpayers Comprehensive Guide To LLCS And S Corps(2018 Edition)

Authors:

Jason Watson

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $11.16

Savings: $11.16(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Taxpayers Comprehensive Guide To LLCS And S Corps

Price:

$9.99

/month

Book details

ISBN: 0692279644, 978-0692279649

Book publisher: Watson CPA Group

Get your hands on the best-selling book Taxpayers Comprehensive Guide To LLCS And S Corps 2018 Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: 2019 Edition just released! This edition includes the major tax reform from the Tax Cuts & Jobs Act of 2017 including Section 199A qualified business income deduction for small businesses.How can I avoid self-employment taxes? This simple question was the inspiration for creating an article describing the benefits of an S Corporation. That original article, which was about four pages long, quickly became a book.Our 2019 Edition of our book will show you-Entity Structure, Including LayeringThe Fallacy of Nevada CorpsState Taxes, Nexus, FBA Problems, and LiabilityS Corp Benefits, Tax SavingsAvoiding Self-Employment TaxesThe 185 Reasons an S Corp or LLC Might StinkForming and Operating an S CorpLate S Corp ElectionDetermining Reasonable S Corp SalarySection 199A Business Tax DeductionTax Deductions, Fringe Benefits, Kids on Payroll and CarsProperly Paying for Health InsuranceSmall Business Retirement Planning with Your S CorpEach week we receive several phone calls and emails from small business owners and other CPAs across the country who have read our Taxpayer’s Comprehensive Guide to LLCs and S Corps and praised the wealth of information. Regardless of your current situation, whether you are considering starting your own business or entertaining a contracting gig, or you are an experienced business owner, the contents of this book are for you.This book is written with the general taxpayer in mind. Too many resources simply regurgitate complex tax code without explanation. While in some cases tax code and court opinions are duplicated verbatim because of precision of the words, this book strives to explain many technical concepts in layperson terms with some added humor and opinions. We believe you will find this book educational as well as amusing.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Shanelle Purvis

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."