Go back

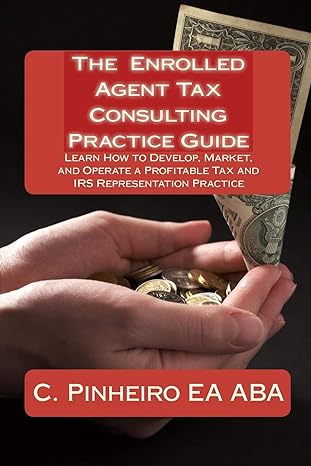

The Enrolled Agent Tax Consulting Practice Guide Learn How To Develop Market And Operate A Profitable Tax And Irs Representation Practice(1st Edition)

Authors:

C. Pinheiro

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $24.99

Savings: $24.99(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for The Enrolled Agent Tax Consulting Practice Guide Learn How To Develop Market And Operate A Profitable Tax And Irs Representation Practice

Price:

$9.99

/month

Book details

ISBN: 0982266049, 978-0982266045

Book publisher: PassKey Publications

Get your hands on the best-selling book The Enrolled Agent Tax Consulting Practice Guide Learn How To Develop Market And Operate A Profitable Tax And Irs Representation Practice 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: The main issue that tax practitioners face is how to grow and promote their practices. In talking with tax professionals, their questions are always the same:"How do I build up my client base?""Are engagement letters really necessary?""How do I encourage more client referrals?""How much should I charge for services?""How do I FIRE a bad client?"This book offers real answers to all of these burning questions. You will read multiple interviews with established, highly profitable EAs. You will hear how other EAs keep their practices profitable and keep clients (and money) rolling in. This book covers: 1. Marketing techniques for enrolled agents 2. How to use the internet and social networking to boost your community profile 3. How to find profitable IRS representation cases 4. How to avoid deadbeat clients 5. How to get lucrative referrals from other professionals and much more! If you have the tax knowledge and a desire to succeed in this business, this book will help you realize your own success.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Request ctmfvdf

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."