Go back

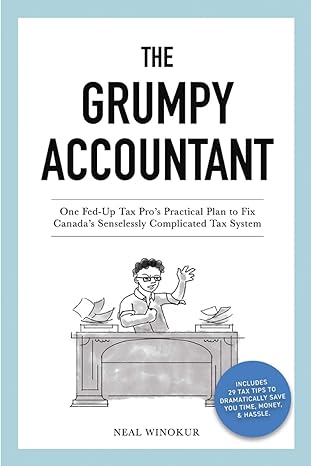

The Grumpy Accountant One Fed Up Tax Pros Practical Plan To Fix Canadas Senselessly Complicated Tax System(1st Edition)

Authors:

Neal Winokur

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $15.22

Savings: $15.22(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for The Grumpy Accountant One Fed Up Tax Pros Practical Plan To Fix Canadas Senselessly Complicated Tax System

Price:

$9.99

/month

Book details

ISBN: 1777226406, 978-1777226404

Book publisher: Neal Winokur

Get your hands on the best-selling book The Grumpy Accountant One Fed Up Tax Pros Practical Plan To Fix Canadas Senselessly Complicated Tax System 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: An entertaining and easy-to-read book about a practical blueprint to simplify Canada's horribly frustratingly overly complicated tax system. The author shares his frustration with a wildly inefficient, impossibly complex and heartlessly impersonal bureaucracy that routinely ensnares honest, hard-working people in its labyrinthine maze. The Grumpy Accountant tells the story of Jerry, a typical Canadian, and George, his trusted grumpy accountant, who guides him through the tax system at every stage in life.The Grumpy Accountant offers 29 critical tax tips for navigating the current broken system, including: -How to avoid common mistakes that invite CRA scrutiny-How to maximize the tax credits, deductions and benefits that you're entitled to-Tax saving strategies for every stage in life: college/university, employment/self-employment, marriage, kids, entrepreneurship, and retirement-How to use online tools to keep organized and stay ahead of the gameWith an entertaining and easy-to-read style, Winokur reveals a practical, ready-to-implement blueprint for change and simplification. Ready to see what a simpler tax future looks like, while saving serious time, money and heartache now? Let The Grumpy Accountant show you the way.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Mildred Rice

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."