Go back

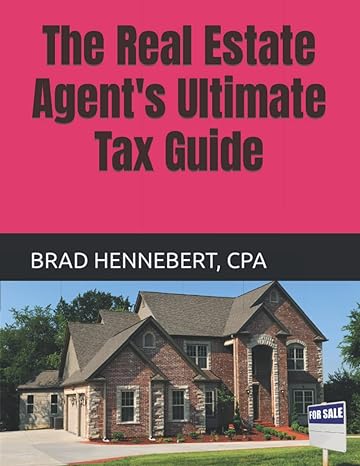

The Real Estate Agents Ultimate Tax Guide(1st Edition)

Authors:

Brad Hennebert

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $17.95

Savings: $17.95(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for The Real Estate Agents Ultimate Tax Guide

Price:

$9.99

/month

Book details

ISBN: 979-8760262370

Book publisher: Independently published (November 5, 2021)

Get your hands on the best-selling book The Real Estate Agents Ultimate Tax Guide 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: Attention Real Estate Agents! How You Can Save up to $22,300 or more on your TAXES THIS YEAR! Almost every real estate agent is self-employed, and the tax code has countless deductions built into it that only self-employed business owners such as you can take! These deductions can mean saving many thousands of dollars of your HARD- EARNED money – money YOU USED TO HAVE TO SEND TO THE IRS. But not any longer!There is one hitch, though….The IRS doesn't spontaneously apply those deductions on your behalf for you. You have to know, in advance, what the tax law allows you to write off as a deduction. Most of these deductions are NOT AVAILABLE to W2 employees who get a regular paycheck every two weeks. And you have to know how to plan for these deductions, and properly document them. The strategies and methods in this manual are geared toward normally motived real estate professionals, and take little in the way of financial investment to make them succeed. No special skills, or even moderately-hard work are required! Just follow the plan! I can virtually guarantee that there are thousands of dollars in deductions, that you would be eligible for, that you aren’t taking now! If you’re not taking deductions to which you’re entitled, its like flushing your money down the toilet! You could be wasting the proceeds from one or two closings you made this year, just on bad tax planning! Don’t let that happen because there’s some specialized knowledge you DON’T have. We’ll also keep you out of trouble with the section on common Tax Myths – things people write off all the time, that they’re just not allowed to! Just knowing what not to do can save you a ton of money in penalties, interest and stress!UPDATED WITH A NEW CHAPTER ON PROPERTY FLIPPING.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Lucia Folerias

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."