Go back

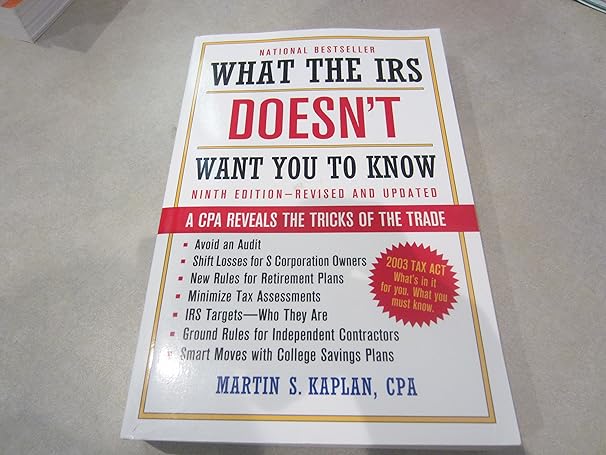

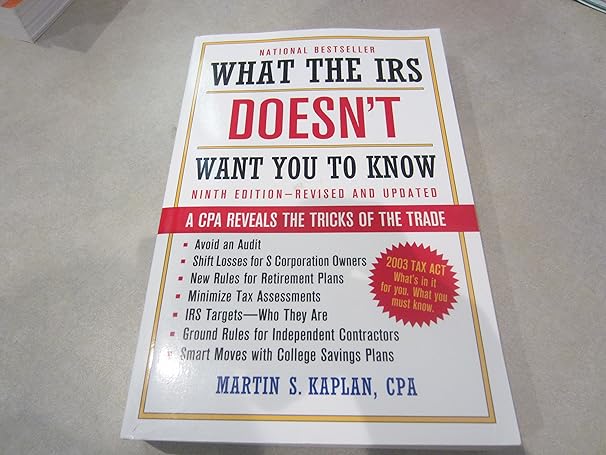

What The Irs Doesnt Want You To Know(9th Edition)

Authors:

CPA Martin S. Kaplan

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $12.92

Savings: $12.92(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for What The Irs Doesnt Want You To Know

Price:

$9.99

/month

Book details

ISBN: 0471449725, 978-0471449720

Book publisher: John Wiley &Sons

Get your hands on the best-selling book What The Irs Doesnt Want You To Know 9th Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: With tax laws constantly changing and existing regulations hidden in volumes of tax code, nothing related to taxes is easy to figure out. Businesses and individuals in every income bracket need expert advice that cuts through the IRS bureaucracy and shows them how to work within the system. In What the IRS Doesn't Want You to Know: A CPA Reveals the Tricks of the Trade, tax expert Martin S. Kaplan reveals critical strategies that the best CPAs use for their clients to file shrewd, legal, money-saving returns. Filled with in-depth insights and practical advice, this book will help you answer such questions as: * How can you approach the "new" IRS to maximize your tax return success? * What are the latest IRS weapons? * What are the biggest taxpayer misconceptions? * What are the most commonly overlooked credits and deductions? * How will new tax legislation affect you? * How can outdated IRS technology benefit you? * What forms should you never fill out? From deciphering the Jobs and Growth Tax Relief Reconciliation Act of 2003 to understanding the personality of the IRS, What the IRS Doesn't Want You to Know will help you shape your tax strategies and stay on top of your current financial situation.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Cesar sandoval

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."