Go back

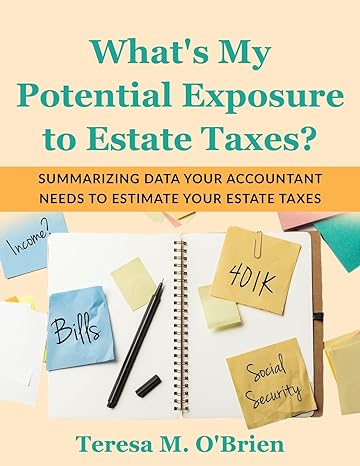

Whats My Potential Exposure To Estate Taxes Summarizing Data Your Accountant Needs To Estimate Your Estate Taxes(1st Edition)

Authors:

Teresa M OBrien

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $10.99

Savings: $10.99(100%)

Book details

ISBN: 1737943212, 978-1737943211

Book publisher: O'Brien Consulting Group, LLC

Get your hands on the best-selling book Whats My Potential Exposure To Estate Taxes Summarizing Data Your Accountant Needs To Estimate Your Estate Taxes 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: What’s My Potential Exposure to Estate Taxes?What’s My Potential Exposure to Estate Taxes? is designed specifically for people who have significant assets and want to assess the magnitude of their potential exposure to future estate taxes. Do not use your net worth as a sole guide for determining your potential estate tax bill. The IRS values many assets differently for estate tax purposes than a net worth calculation does.What’s My Potential Exposure to Estate Taxes? will help organize your assets and liability information so you and your accountant can understand how much of your estate might be subject to taxes. It’s like having a guide to help you help your accountant with information on one aspect of your wealth preservation. Save your accountant time and yourself money by pulling together this information for your accountant. What’s My Potential Exposure to Estate Taxes? summarizes your information consistent with IRS Form 706 for calculating estate taxes. The information is divided into 2 key areas –Estimating total gross estate andEstimating allowable deductionsEach of the subsections in these two key areas contain tables that correspond to the specific schedule in IRS Form 706 for calculating estate taxes. Once completed, this book can be a ready-reference for you going forward.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Henry lukuba

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."