Go back

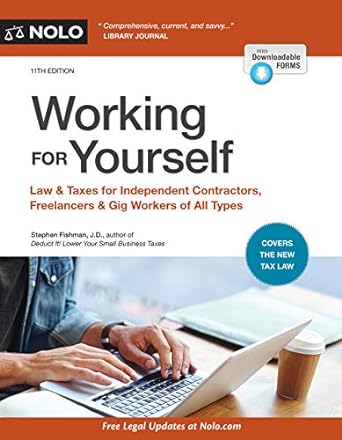

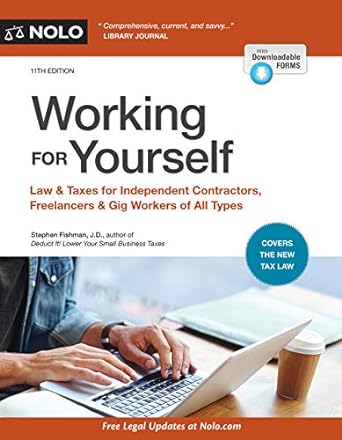

Working For Yourself Law And Taxes For Independent Contractors Freelancers And Gig Workers Of All Types(11th Edition)

Authors:

Stephen Fishman J.d. Edition

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $14.00

Savings: $14(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Working For Yourself Law And Taxes For Independent Contractors Freelancers And Gig Workers Of All Types

Price:

$9.99

/month

Book details

ISBN: 1413325815, 978-1413325812

Book publisher: NOLO

Get your hands on the best-selling book Working For Yourself Law And Taxes For Independent Contractors Freelancers And Gig Workers Of All Types 11th Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: The all-in-one legal and tax resource every independent contractor and gig worker needs Whether you’re starting a full-scale consulting business or booking gigs on the side, Working for Yourself provides all the legal and tax information you need in one place. This eleventh edition has been thoroughly updated to reflect all the changes under the Tax Cuts and Jobs Act?changes that are largely beneficial to the self-employed. This excellent, well-organized reference will also show you how to: decide the best form for your business (sole proprietor, LLC, or other) make sure you’re paid in full and on time pay estimated taxes and avoid trouble with the IRS take advantage of all available tax deductions, including the 20% pass-through tax deduction for business owners choose health, property, and other kinds of insurance keep accurate records in case you get audited, and write legally binding contracts and letter agreements. If you’re tired of doing endless web searches for the information you need to start and run your business, this easy-to-use and authoritative resource is for you.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Request vbtxi5

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."