The 2011 annual report of Wal-Mart, a major retailing company, listed the following property and equipment ($

Question:

The 2011 annual report of Wal-Mart, a major retailing company, listed the following property and equipment ($ in millions):

Property and equipment, at cost …………. $148,584

Less: Accumulated depreciation …………. 43,486

Property and equipment, net …………….. $105,098

The cash balance was $7,395 million. Depreciation expense during the year was $7,641 million. The condensed income statement follows ($ in millions):

Revenues ………………………………… $421,849

Expenses ………………………………… (396,307)

Operating income ……………………….. $ 25,542

For purposes of this problem, assume that all revenues and expenses, excluding depreciation, are for cash. Thus, cash operating expenses in millions of dollars were ($396,307 – $7,641) = $388,666.

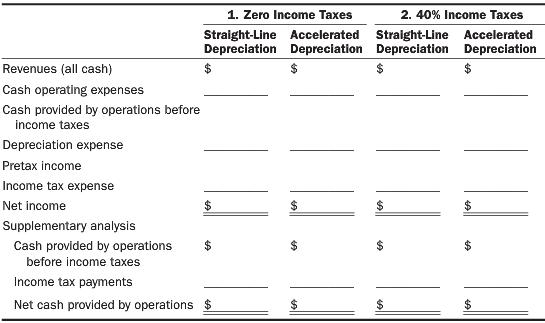

1. Wal-Mart uses straight-line depreciation. If accelerated depreciation had been used, assume that depreciation would have been $9,641 million. Assume zero income taxes. Fill in the first two columns of blanks in the accompanying table ($ in millions).

2. Fill in the last two columns of blanks in the table above. Assume an income tax rate of 40%. Assume also that Wal-Mart uses the same depreciation method for reporting to shareholders and to income tax authorities.

3. Compare your answers to requirements 1 and 2. Does depreciation provide cash? Explain as precisely as possible.

4. Refer to requirement 2. Assume that Wal-Mart had used straight-line depreciation for reporting to shareholders and to income tax authorities. Indicate the change (increase or decrease and amount) in the following balances if Wal-Mart had used accelerated depreciation for shareholder and tax reporting instead of straight-line during that year: Cash, Accumulated Depreciation, Pretax Income, Income Tax Expense, and Retained Earnings. What would be the new balances in Cash and Accumulated Depreciation?

5. Refer to requirement 1 where there are zero taxes. Suppose Wal-Mart increased depreciation by an extra $2,750 million under both straight-line and accelerated methods. How would cash be affected? Be specific.

Step by Step Answer:

Introduction to Financial Accounting

ISBN: 978-0133251036

11th edition

Authors: Charles Horngren, Gary Sundem, John Elliott, Donna Philbrick