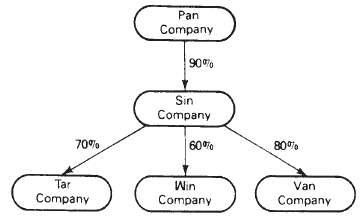

The affiliation structure for a group of interrelated companies is diagrammed as follows: The investments were acquired

Question:

The affiliation structure for a group of interrelated companies is diagrammed as follows:

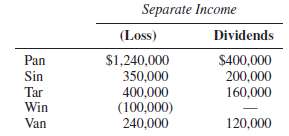

The investments were acquired at fair value equal to book value in 2011, and there are no unrealized or constructive profits or losses.Separate incomes and dividends for the companies for 2011 are:

1. The noncontrolling interest share of Tar Company's net income for 2011 is:(a) $120,000(b) $148,000(c) $252,000(d) $280,0002. The noncontrolling interest share of Van Company's net income for 2011 is:(a) $48,000(b) $96,000(c) $110,400(d) $144,0003. The total noncontrolling interest share that should appear in the consolidated income statement for 2011 is:(a) $244,200(b) $210,200(c) $204,200(d) $76,2004. Controlling share of consolidated net income for Pan Company and Subsidiaries for 2011 is:(a) $1,925,800(b) $1,881,800(c) $1,240,000(d) $685,8005. Pan's Investment in Sin account should reflect a net increase for 2011 in the amount of:(a) $762,000(b) $685,800(c) $625,800(d) $505,800

Consolidated Income StatementWhen talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith