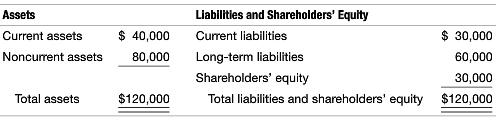

The balance sheet as of December 31, 2015, for Boyton Sons follows: The company needs capital to

Question:

The balance sheet as of December 31, 2015, for Boyton Sons follows:

The company needs capital to finance operations and purchase new equipment. Boyton is not certain how much money it will need and is considering one of the following three-year notes payable. Each note would mature on January 1, 2019.

(A) Face value = $50,000 Stated interest rate = 0% Proceeds = $37,566

(B) Face value = $50,000 Stated interest rate = 10%* Proceeds = $50,000

(C) Face value = $50,000 Stated interest rate = 6%* Proceeds = $45,027

*Interest paid annually.

REQUIRED:

a. Determine the effective interest rate of each note.

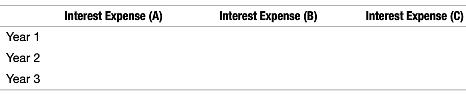

b. Compute the amounts that would complete the following table:

c. Assume that Boyton can earn a 12 percent return on the borrowed money and that it reinvests all interest that it earns. Compute the annual income (return – Interest expense) generated from each of the three notes.

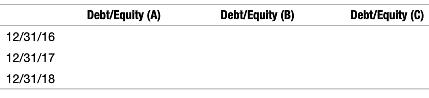

d. Compute the amounts that would complete the following chart.

e. Discuss some of the trade-offs involved in choosing among the three notes.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer: