Question:

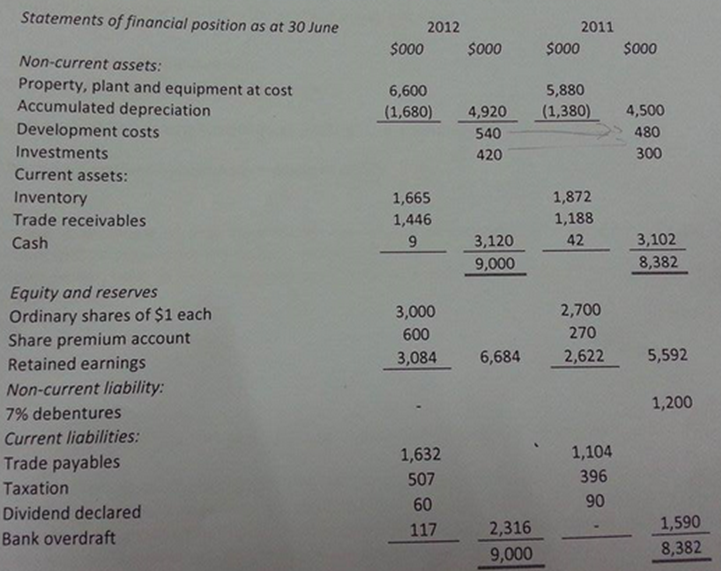

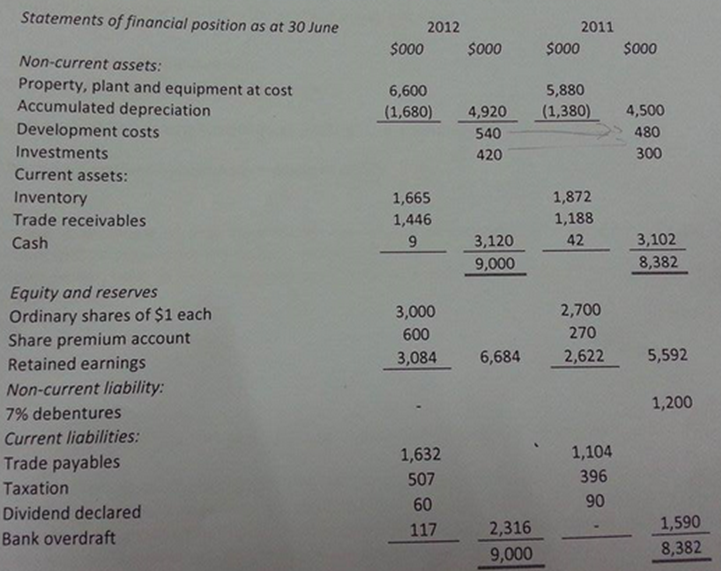

The financial statements of Royce pic have been prepared as follows:

a. Extract from statement of income

€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦$000

Operating profit€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦1,008

Dividend received€¦€¦€¦€¦€¦€¦€¦€¦€¦..€¦36

Premium on Debentures €¦€¦€¦€¦€¦(120)

Interest paid€¦€¦€¦€¦€¦€¦..€¦€¦€¦€¦€¦.(144)

Profit before taxation€¦€¦€¦€¦€¦€¦€¦780

Income tax€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦..(258)

Profit after tax€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦...$22

b. Operating expenses written off in the year include the following:

€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦..€¦$000

Amortisation of development cost€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦.102

Depreciation of property, plant and equipment€¦€¦..318

c. Equipment which had cost $240,000 was sold in the year, incurring a loss of $156,000.

d. The debentures were redeemed at a premium of 10%.

Required

Prepare a statement of cash flows for the year ended 30 June 2012, in accordance with IAS 7.

Statement of Cash Flows using the indirect method.

Transcribed Image Text:

The financial statements of Royce plc have been prepared as follows: Statements of financial position as at 30 June 2012 2011 $000 $000 $000 $000 Non-current assets: Property, plant and equipment at cost Accumulated depreciation Development costs Investments Current assets: Inventory Trade receivables Cash 6,600 5,880 (1,680) 4,920 (1,380) 4,500 480 300 540 420 1,665 1,446 9 1,872 1,188 3,120 9,000 42 3,102 8,382 Equity and reserves Ordinary shares of $1 each Share premium account Retained earnings Non-current liability: 7% debentures Current liabilities: Trade payables Taxation Dividend declared Bank overdraft 3,000 600 3,084 2,700 270 2,622 6,684 25024 5,592 1,200 1,104 396 90 1,632 507 60 1172,316 1,590 8,382 9,000 Further information: (a)Extract from statement of income Operating profit Dividend received Premium on Debentures Interest paid Profit before taxation Income tax Profit after tax $000 1,008 36 (120) (144) 780 (258 522 (b) Operating expenses written off in the year include the following: Amortisation of development costs Depreciation of property, plant and equipment $000 102 318 (c) Equipment which had cost $240,000 was sold in the year, incurring a loss of $156,000 (d) The debentures were redeemed at a premium of 10% Required: a. Prepare a statement of cash flows for the year ended 30 June 2012, in accordance with lAS 7 g the indirect method. (15 marks)