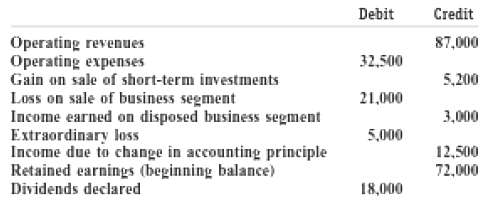

The following information was taken from the 2012 financial records of Rothrock consolidated. All items are pretax.

Question:

The following information was taken from the 2012 financial records of Rothrock consolidated. All items are pretax.

The company's income tax rate is 35 percent, and the item above are treated identically for financial reporting and tax purposes.Prepare the following:(a) An income statement.(b) A reconciliation of retained earnings.

Transcribed Image Text:

Debit Credit Operating revenues Operating expenses Gain on sale of short-term investments 87,000 32,500 5,200 Loss on sale of business segment Income earned on disposed business segment Extraordinary loss Income due to change in accounting principle Retained earnings (beginning balance) Dividends declared 21,000 3,000 5,000 12,500 72,000 18,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 76% (13 reviews)

a Rothrock Consolidated Income Statement For the Year Ended December 31 2012 Revenue Operating reve...View the full answer

Answered By

ANDREW KIPRUTO

Academic Writing Expert

I have over 7 years of research and application experience. I am trained and licensed to provide expertise in IT information, computer sciences related topics and other units like chemistry, Business, law, biology, biochemistry, and genetics. I'm a network and IT admin with +8 years of experience in all kind of environments.

I can help you in the following areas:

Networking

- Ethernet, Wireless Airmax and 802.11, fiber networks on GPON/GEPON and WDM

- Protocols and IP Services: VLANs, LACP, ACLs, VPNs, OSPF, BGP, RADIUS, PPPoE, DNS, Proxies, SNMP

- Vendors: MikroTik, Ubiquiti, Cisco, Juniper, HP, Dell, DrayTek, SMC, Zyxel, Furukawa Electric, and many more

- Monitoring Systems: PRTG, Zabbix, Whatsup Gold, TheDude, RRDtoo

Always available for new projects! Contact me for any inquiries

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Managerial Accounting questions

-

The following information was taken from the 2012 financial records of Price Restaurant Supply Company: The company sold a piece of plant equipment for cash that had originally cost $100,000. The...

-

The following information was taken from the 2012 financial statements of Dentsply International, a company that develops, manufactures, and markets medical equipment and supplies for the global...

-

The federal corporate income tax rate is 35 percent and firms may carry back losses for two years and carry forward losses for 20 years. The carry-back must occur before carry-forward. A corporation...

-

The Louisiana Grill The Louisiana Grill (TLG) is a restaurant in Toronto. TLG is a regional restaurant created and operated by Alex Ven- tresca, a former football player from New Orleans. The company...

-

Fior Ramirez worked as a housekeeper for Remington Lodging & Hospitality, a hotel in Atlantic Beach, Florida. After her father in the Dominican Republic suffered a stroke, she asked her employer for...

-

Which of the following statements is true? I. Private not-for-profit universities must report depreciation expense. II. Public universities must report depreciation expense. a. Neither I nor II is...

-

Now, continue developing your Gantt chart with the rest of the information contained in the table in Exercise 10.19, and create a complete activity network diagram for this project.

-

Which problems described in the article are the most serious for virtual projects? Which might be fatal?

-

Fill in the t-accounts for each situation and label each transaction as Deferrals/Prepaid, Accrual, or Depreciation. Use Unadj. Bal. as the label for the opening balance of each account. Calculate...

-

The police arrested James and Will for murder. Wills trial was first. He was acquitted because his minister testified that they had spent the evening of the murder playing Scrabble together. Later,...

-

The following income statement was reported by battery Builders for the year ending December 31, 2012: Show how battery builders would report earrings per share on the face of the income statement,...

-

The following pretax amounts were obtained from the financial records of Watson Company for 2012: The company's tax rate is 35 percent.(a) Prepare an income statement for the year ended December 31,...

-

Ratio Analysis} Valiant Corporation has \(\$ 1,800,000\) in total liabilities, \(\$ 800,000\) of which are current. Valiant has \(\$ 400,000\) of cash and cash equivalents; \(\$ 300,000\) of other...

-

Companies that engage international business do so in pursuit of a broad range of goals. Nonetheless, the text identifies key drivers, noting that the typical company expands operations...

-

How do lifestyle changes, such as urbanization or an aging population, affect consumer needs and preferences in our industry?

-

Verify that the following general thermodynamic property relationships are valid for the specific case of an ideal gas: (a) T = au (b) P = -9) av

-

Performance management systems that do not make true contribution to the organizational goals are not true performance management systems. List and describe at least five contributions a good...

-

How do cognitive biases, such as confirmation bias and anchoring, influence strategic decision-making processes at the executive level, and what measures can be implemented to mitigate their impact ?

-

These are selected 2007 transactions for Neuman Corporation: Jan. 1 Purchased a copyright for $140,000. The copyright has a useful life of 8 years and a remaining legal life of 30 years. May 1...

-

Distinguish among total-moisture content, free-moisture content, equilibrium-moisture content, unbound moisture, and bound moisture.

-

When an aqueous solution of H 2 S(aq) is mixed with an aqueous solution of copper(II) sulfate, a black precipitate of CuS forms. (a) Write and balance the full reaction equation for the reaction of H...

-

In its 2012 annual report, Home Depot reported that fiscal 2012 sales increased to $74.8 billion (from $70.4 billion the previous fiscal year), while profits increased to $4.5 billion (from $3.9...

-

United Continental Holdings, the parent of United Airlines and Continental Airlines, signed contracts with its major creditors (mostly banks) that require the company to maintain a minimum cash...

-

a. Briefly describe the operations of Google and indicate whether it is a manufacturing, retail, or Service Company. b. Which accounting firm audits Google? Briefly explain the contents of the audit...

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

Study smarter with the SolutionInn App