The income statement for the year ended December 31, 2012, for Laskowski Manufacturing Company contains the following

Question:

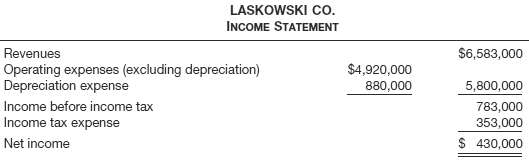

The income statement for the year ended December 31, 2012, for Laskowski Manufacturing Company contains the following condensed information.

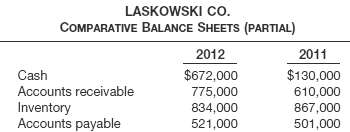

Included in operating expenses is a $24,000 loss resulting from the sale of machinery for $270,000 cash. The company purchased machinery at a cost of $750,000.Laskowski reports the following balances on its comparative balance sheets at December 31.

Income tax expense of $353,000 represents the amount paid in 2012. Dividends declared and paid in 2012 totaled $200,000.AccountingPrepare the statement of cash flows using the indirect method.AnalysisLaskowski has an aggressive growth plan, which will require significant investments in plant and equipment over the next several years. Preliminary plans call for an investment of over $500,000 in the next year. Compute Laskowski's free cash flow (from Chapter 5) and use it to evaluate the investment plans with the use of only internally generated funds.PrinciplesHow does the statement of cash flows contribute to achieving the objective of financialreporting?

Free Cash FlowFree cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer: