The minutes of the board of directors of Mary- gold Catalogue Company Ltd. for the year ended

Question:

The minutes of the board of directors of Mary- gold Catalogue Company Ltd. for the year ended December 31, 2011, were provided to you.

Meeting of February 16, 2011

Ruth Ho, chair of the board, called the meeting to order at 4:00 p.m. The following directors were in attendance:

Margaret Aronsond …………. Claude La Rose

Fred Brick ………………….. Lucille Renolds

Henri Chapdelaine ………….. J. T. Schmidt

Ruth Ho ………………………… Marie Titard

Homer Jackson …………………. Roald Asko

equipment had been acquired in 2010, be donated to the Kingston Vocational School for use in their repair and train¬ing program. Margaret Aronson seconded the motion and it was unanimously passed.

Annual cash dividends were unanimously approved as being payable April 30, 2011, for shareholders of record April 15, 2011, as follows:

Class A common—$10 per share Class B common—$5 per share

Officers’ bonuses for the year ended December 31, 2010, were approved for payment March 1, 2011, as follows:

Marie Titard—President $26,000 Lucille Renolds—Vice-President $12,000 Roald Asko—Controller $12,000 Fred Brick—Secretary-Treasurer $9,000

Meeting adjourned 6:30 p.m.

Fred Brick, Secretary

Meeting of September 15, 2011

Ruth Ho, chair of the board, called the meeting to order at 4:00 p.m. The following directors were in attendance:

Margaret Aronsond …………. Claude La Rose

Fred Brick ………………….. Lucille Renolds

Henri Chapdelaine ………….. J. T. Schmidt

Ruth Ho ………………………… Marie Titard

Homer Jackson …………………. Roald Asko

The minutes of the meeting of February 16, 2011, were read and approved. Marie Titard, president, discussed the improved sales and financial condition for 2011. She was pleased with the results of the catalogue distribution and cost control for the company. No action was taken.

The nominations for officers were made as follows: President—Marie Titard Vice-President—Lucille Renolds Controller—Roald Asko Secretary-Treasurer—Fred Brick

The nominees were elected by unanimous voice vote.

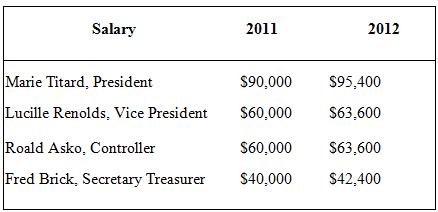

Salary increases of 6 percent, exclusive of bonuses, were recommended for all officers for 2012. Marie Titard moved that such salary increases be approved; the proposal was seconded by J. T. Schmidt and unanimously approved.

Roald Asko moved that the company consider adopting a pension/profit-sharing plan for all employees as a way to provide greater incentive for employees to stay with the company. Considerable discussion ensued. It was agreed without adoption that Asko should discuss the legal and tax implications with lawyer Cecil Makay and a public accounting firm reputed to be knowledgeable about pension and profit-sharing plans, Able and Bark. Roald Asko discussed the expenditure of $58,000 for acquisition of an information system for the Kingston office to replace equipment that was purchased in 2010 and has proven ineffective. Asko moved that the transaction be approved; the move was seconded by Jackson and unanimously adopted. Fred Brick moved that a loan of $36,000 from Kingston Bank be approved. The interest is floating at 2 percent above prime. The collateral is to be the new hardware and software being installed in the Kingston office. A chequing account, with a minimum balance of $2,000 at all times until the loan is repaid, must be opened and maintained if the loan is granted. The proposal was seconded by La Rose and unanimously approved.

Lucille Renolds, chair of the audit committee, moved that the public accounting firm of Moss & Lawson be selected again for the company’s annual audit and related tax work for the year ended December 31, 2012. This was seconded by Aronson and unanimously approved.

Meeting adjourned 6:40 p.m.

Fred Brick, Secretary

REQUIRED

a. How do you, as the auditor, know that all minutes have been made available to you?

b. Read the minutes of the meetings of February 16 and September 15. Use the format on the next page to list and explain information that is relevant to the 2011 audit.

c. Read the minutes of the meeting of February 16, 2011. Did any of that information pertain to the December 31, 2010, audit? Explain what the auditor should have done during the December 31, 2010, audit with respect to the 2011 minutes.

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Auditing The Art and Science of Assurance Engagements

ISBN: 978-0133098235

12th Canadian edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Ingrid B. Splettstoesser