The purchase schedule for Laundryman's Corporation is as follow: The inventory balance as of the beginning of

Question:

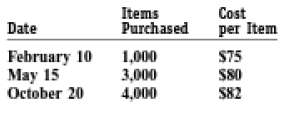

The purchase schedule for Laundryman's Corporation is as follow:

The inventory balance as of the beginning of the year was $35,000 (500 units @ $70 each). During the year ended December 31, the company sold 6,000 units for $150 per unit. Expenses other than cost of goods sold totaled $125,000. The effective income tax rate is 30 percent.REQUIRED:a. Prepare three income statements, one under each assumption-FIFO, LIFO, average.b. How many tax dollars would be saved by using LIFO instead of FIFO?c. Assume the market value of an item of inventory dropped to $78 as of the end of the year. Apply the lower-of-cost-or-market rule, and provide the appropriate journal entry (if necessary) under the FIFO, LIFO, and average assumptions.d. Repeat (a) above, assuming the cost per item were:Beginning inventory.....$80February 10.........$78May 15.............$77October 20..........$75Which of the three assumptions now gives rise to the highest net income and endinginventory?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer: