The Robinson Company from Problem 2 had net sales of $1,200,000 in 2010 and $1,300,000 in 2011.

Question:

The Robinson Company from Problem 2 had net sales of $1,200,000 in 2010 and $1,300,000 in 2011.

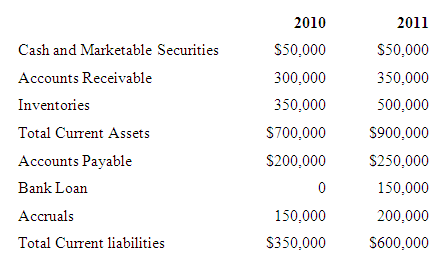

The Robinson Company had the following current assets and current liabilities for these two years: If sales in 2010 were $1.2 million, sales in 2011 were $1.3 million, and cost of goods sold was 70 percent of sales, how long were Robinson’s

a. Determine the receivables turnover in each year.

2010 2011

AR turnover

b. Calculate the average collection period for each year.

2010 2011

Average collection period

c. Based on the receivables turnover for 2010, estimate the investment in receivables if net sales were $1,300,000 in 2011.

Receivables investment

d. How much of a change in the 2011 receivables occurred?

Expected change in AR

Actual change in AR

Step by Step Answer:

Introduction to Finance Markets Investments and Financial Management

ISBN: 978-1118492673

15th edition

Authors: Melicher Ronald, Norton Edgar