The table below shows the annual change in the average U.S. home price from 2005 to 2014

Question:

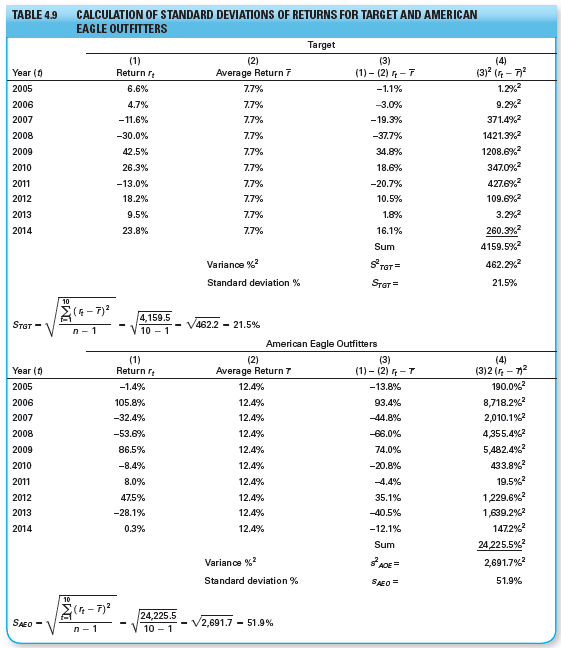

The table below shows the annual change in the average U.S. home price from 2005 to 2014 according to the S&P/Case-Shiller Index. Calculate the average annual return and its standard deviation. Compare this to the average return and standard deviation for Target Corporation and American Eagle Outfitters, Inc., shown in Table 4.9. In terms of average return and standard deviation, how does residential real estate compare as an investment relative to those two common stocks?

Year __________% Change

2005 ................... 15.5%

2006 .................... 0.7%

2007 .................. - 9.0%

2008 ................. - 18.6%

2009 .................. - 3.1%

2010 .................. - 2.4%

2011 .................. - 4.1%

2012 ................... 6.9%

2013 .................. 13.4%

2014 ................... 4.5%

Data from Table 4.9

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9780134083308

13th Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk